FEATURES

Property Market Forecasts

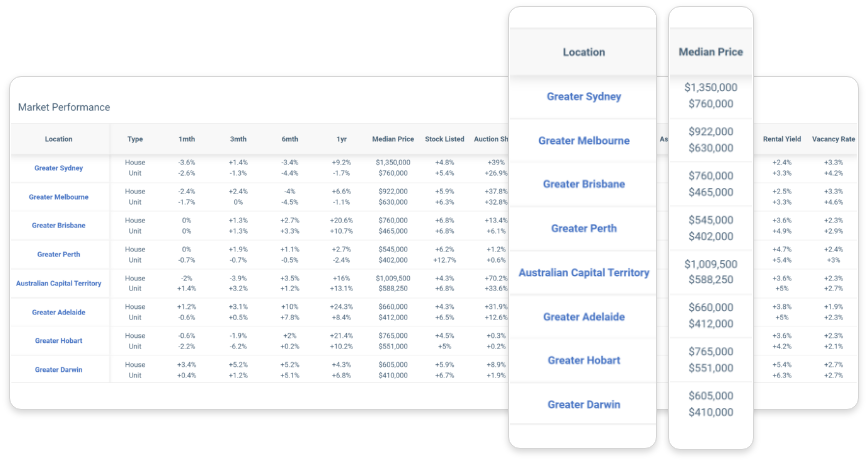

Property Market Performance

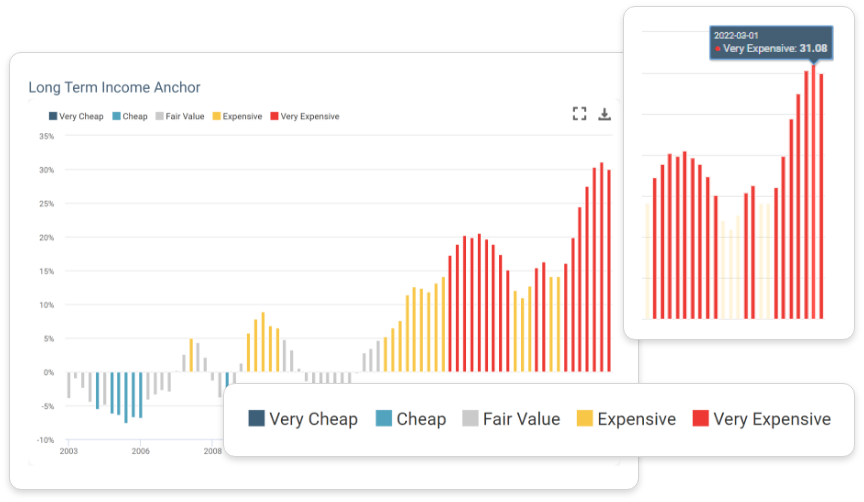

Long-Term Income Anchor

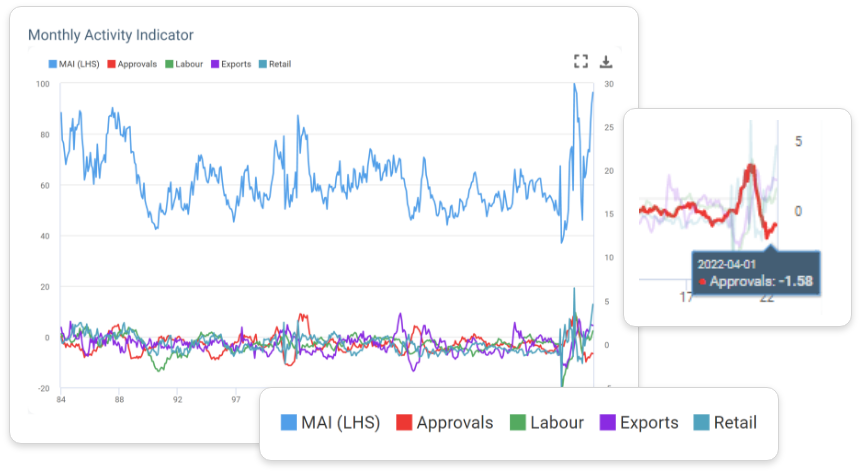

Monthly Activity Indicator

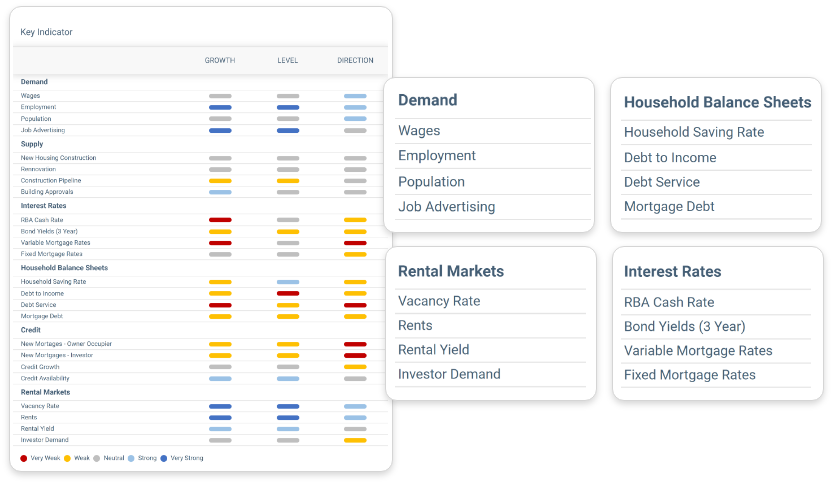

Key Economic Indicators

Market Scanner

The Property Market Forecast Table summarises all of the Australian residential property market forecasts available on HALO Property. Houses and apartments are forecasted separately and geographically split into state and territories, capital cities and regional areas over 1 year, 3 year, 5 year and 10 year forecasts.

The Market Performance Table provides a snapshot of the recent performance of property markets across Australia based on CoreLogic’s median house prices data for capital cities and regional areas for houses and apartments. The performance table measures changes in property price levels over time but does not take into account transactions costs, funding costs or rental yields or other income from property. They are not a total return measure and should be used as a guide to general price trends in the market.

The Long-Term Income Anchor (LTIA) is a macroeconomic valuation tool that shows how far property prices have deviated from their fundamental long-term fair-value based on household incomes. This chart uses average household income to explain why property prices vary across different locations as well as how changes in household incomes impact property prices over time. Household income levels not only explain relative property prices across different locations but will also provide a valuation anchor for property prices over time. The LTIA is the foundation of household purchasing power which, when combined with funding costs such as interest rates, are the main determinant of the demand for property and property prices. With the LTIA, investors can gain valuable insights into how expensive or cheap a property market is compared to their long-run fundamentals.

The Monthly Activity Indicator (MAI) is a summary of key economic data presented as a single indicator to provide insights into general economic trends. The MAI is useful investors to provide a snapshot of how the overall economy is performing.

The Key Indicators chart provide insights into relevant economic and property market developments to help monitor and understand market developments in real time. These will range from common economic and property indicators such as employment and building approvals to more sophisticated analytical indicators such as debt to income ratios or consumer debt services measures. These will be updated with the latest data and will be rotated to reflect issues that are front of mind for market participants. The Key indicators will be used regularly by Warren Hogan in his market updates and outlook webinars and reports.

The Market Scanner allows investors to find opportunities that match their investment criteria. Select filters based on your investment style to identify the suburbs that best match your objectives right around Australia.

HALO Property is powered by Australia’s leading source of property data and analytics, CoreLogic Australia.

HALO Technologies is dedicated to building market-leading investment technology products for investors.

Need some help? The HALO Help team is standing by to provide you with support by phone, email and live chat.

EXPERT TEAM

Warren Hogan is a renowned economist with a track record of analyzing and forecasting the Australian Economy. As the former chief economist of both ANZ and Credit Suisse Australia, and Principal Advisor at The Australian Treasury, Warren is a regular and highly-sought after commentator in the media. He is currently the Economic Advisor to Judo Bank, and the Managing Director of EQ Economics, a micro advisory firm specialising in the strategic planning and forecasts for Australian businesses.

INCLUDED IN YOUR HALO PROPERTY SUBSCRIPTION

Curated by Warren Hogan, the HALO Property Chart Pack will provide expert commentary on the macroeconomic and property market trends in Australia.

Have a question about the property market? Join Warren Hogan live for the HALO Property Market Insights webinar each month covering expert analysis on Australian property markets.

Register your interest in HALO Property

to receive a complimentary walkthrough.

HALO Property is a new online software offering that provides Australian residential property investors with the tools, data and research they need to make smarter investment decisions.

With HALO Property, investors get a more complete view of the property market ranging from top-level macroeconomic drivers of property down to suburb level analysis.

HALO Property combines market-leading property data from CoreLogic Australia, macroeconomic data from the Australian Bureau of Statistics (ABS) and the Reserve Bank of Australia with powerful research tools and analytics developed in-house at HALO Technologies.

To access HALO Property, click on the link below and register your interest. One of our team members will be in contact with you to guide you through the process.

HALO Property is a new online software offering that provides Australian residential property investors with the tools, data and research they need to make smarter investment decisions.

With HALO Property, investors get a more complete view of the property market ranging from top-level macroeconomic drivers of property down to suburb level analysis.

HALO Property combines market-leading property data from CoreLogic Australia, macroeconomic data from the Australian Bureau of Statistics (ABS) and the Reserve Bank of Australia with powerful research tools and analytics developed in-house at HALO Technologies.

To access HALO Property, click on the link below and register your interest. One of our team members will be in contact with you to guide you through the process.

Get the latest insights and hot tips delivered right to your inbox

HALO Technologies Pty Ltd ABN 54 623 830 866 is a Corporate Authorised Representative No 1261916 of Macrovue Pty Ltd ABN 98 600 022 679 AFSL 484264. Macrovue Pty Ltd is a wholly owned subsidiary of HALO Technologies Pty Ltd.