As investors seek to outperform, one source of potential alpha lies in overseas markets. International investing provides investors with returns driven by foreign economies instead of domestic and portfolio diversification benefits. HALO Technologies is now offering company research and market commentary covering the United Kingdom.

Within the United Kingdom, there are two markets, the Main Market and the Alternative Investment Market (AIM). These markets vary by regulatory requirements and the types of companies listed. Companies must meet stringent regulatory requirements before listing on the Main Market, and the AIM market requires fewer regulatory and costly requirements to be satisfied before listing. This difference typically leads to faster-growing companies that are early in the business development cycle to list on AIM instead of the Main Market.

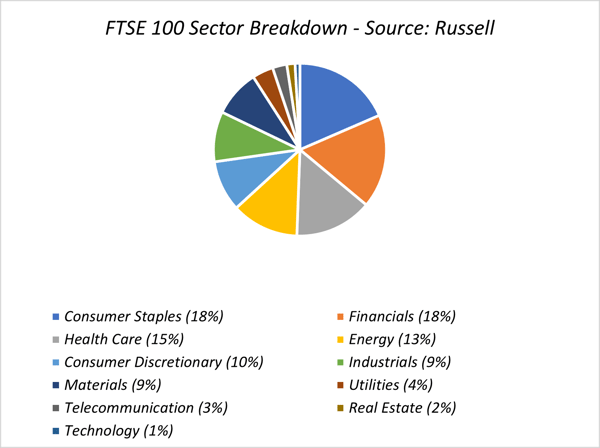

Turning attention to the Main Market, the FTSE All-Share, represents the aggregate of the FTSE 100, FTSE 250, and Small Cap indices. Consumer staples, financials, and health care dominate the composition of the FTSE 100, which many prominent multinational entities from various sectors also call home.

Investors' preconceptions that this index is relatively regional and driven entirely by outcomes of the UK economy may also be misplaced. According to FTSE Russell, FTSE 100 constituents generate over 70% of revenues outside of the UK. The nature of the constituent's revenue base provides investors access to a broad range of themes and returns that may be more global.

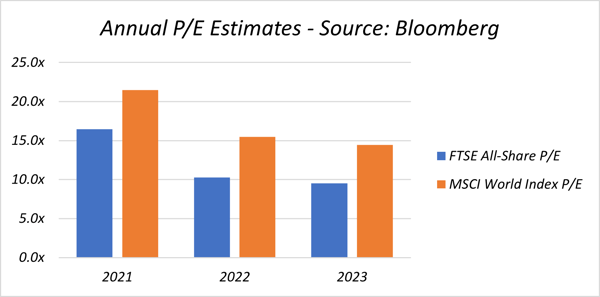

Despite the market's global nature, the FTSE All-Share is trading cheaper on a P/E basis relative to its global peers. MSCI World's P/E for the current year stands at 15.46x against 10.27x for the FTSE All-Share. This valuation gap widens as investors look into 2023, as depicted in the graphic below.

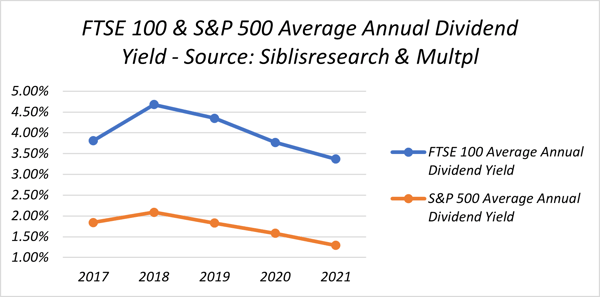

Regardless of trading at a discount relative to the MSCI World, UK equities can be a compelling source of income. UK dividend rates have historically exceeded other developed markets throughout the years. The graphic below compares the average annual dividend yield of the FTSE 100 and the S&P 500 and illustrates the additional historic yield available to investors.

As investor preferences evolve, the importance of strategically aligned and quantifiable ESG measures has come to the forefront. Companies within the FTSE 100 continue to progress in integrating ESG into incentive agreements. PWC reports that almost 60% of the FTSE 100 constituents have integrated an ESG measure into their incentive agreements; this has increased 15% over the previous year.

As investors continue to search for outperformance, examining international markets as a potential source is essential. Looking specifically at the FTSE, some prominent players within the index are:

Other names of potential interest to investors may include:

All information contained in this publication is provided on a factual or general advice basis only and is not intended or be construed as an offer, solicitation, or a recommendation for any financial product unless expressly stated. All investments carry risks and past performance is no indicator of future performance. Before making an investment decision, you should consider your personal circumstances, objectives and needs and seek a professional investment advice. Opinions, estimates and projections constitute the current judgement of the author as at the date of this publication. Any comments, suggestions or views presented in this communication are not necessarily those of HALO Technologies, Macrovue or any of their related entities (‘we’, ‘our’, ‘us’), nor do they warrant a complete or accurate statement.

The opinions and recommendations in this publication are based on a reasonable assessment by the author who wrote the report using information provided by industry resources and generally available in the market. Employees and/or associates of HALO Technologies or any of the other related entities may hold one or more of the investments reviewed in this report. Any personal holdings by HALO Technologies or any of the other related entities employees and/or associates should not be seen as an endorsement or recommendation in any way. HALO Technologies Pty Limited ACN 623 830 866 is a Corporate Authorised Representative CAR: 001261916 of Macrovue Pty Limited ACN:600 022 679 AFSL 484264. MacroVue Pty Limited is a wholly owned subsidiary of HALO Technologies Pty Ltd. These companies are related entities with Amalgamated Australian Investment Group Limited ABN 81 140 208 288 (AAIG).

Get the latest insights and hot tips delivered right to your inbox

HALO Technologies Pty Ltd ABN 54 623 830 866 is a Corporate Authorised Representative No 1261916 of Macrovue Pty Ltd ABN 98 600 022 679 AFSL 484264. Macrovue Pty Ltd is a wholly owned subsidiary of HALO Technologies Pty Ltd.