As the global markets are following the US into a tightening phase, China, due to its Cross/Reverse Cycle Adjustment policies, stepped into an easing phase with strong monetary and fiscal support (including interest rate cut, tax reduction and huge plan for “New” infrastructure spendings), which justified its recent relative strength compared to global equity markets. As investing in China seems difficult for international investors, we analysed the reasons to invest in China, 2 Must-knows and 3 attractive sectors that will benefit from the long term secular changes.

Reasons why investors should diversify their investments into China:

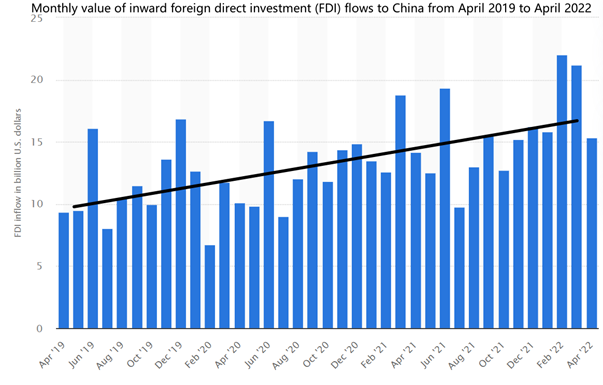

Despite the geopolitical tensions, regulatory risks, Foreign Direct Investment has been on the rise. To some extent, capital is profit-driven and vote with its flow, so ignore the market noise and focus on the size of long-term capital inflows will help investors clearly see the real picture.

It’s a top priority to understand the direction and stage of China’s economic development and especially the policy (fiscal/monetary/regulatory) environment.

Cross/Reverse Cycle adjustment late 2020 to 2021 – de-risk and tight policies vs global easing. China has started de-risking the economy since the beginning of 2021 while global markets are easing and printing money. It started with antitrust actions on Alibaba, Tencent Meituan etc. to prevent from the harm of monopoly, then actions on the housing prices, affordable healthcare (National Volume Based Purchase) and after-class education to reduce pressures of workers, elderly and children.

Cross/Reverse Cycle adjustment Since first quarter of 2022 – easing monetary and fiscal policies vs global tightening (rate hikes). China issued a basket of easing policies including interest rate cut, tax reduction, support for the healthy development of platform economies (internet giants) and huge “new” infrastructure spending plans (5G, dispatchable renewable energy, smart city, IoTs, cloud, digital economy etc.).

So, the easing monetary and fiscal policies provides an investor-friendly environment for global investors to diversify their portfolio allocations.

%20.png?width=778&name=Picture3%20-%20Chinas%20Reverse%20Cycle%20Adjustment%20Stages%20-%20Nasdaq%20Index%20vs%20MSCI%20China%20Index%20(USD)%20.png)

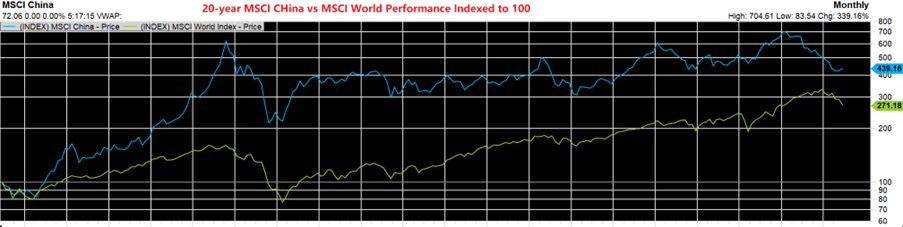

China is showing extremely impressive relative strength vs the rest of the world's equity markets due to the start of its easing and economy stimulating policies.

DO NOT chase the extremely “Hot” sectors: as above mentioned, the return and volatility are both high, investors may suffer huge losses when buying near the peak of a sector boom. For example, the lithium battery index (led by CATL, the world’s No. 1 EV battery supplier with 34.4% global market share) quadrupled in 3 years and it’s quite natural to expect some major drawdowns/corrections before the valuation revert to a reasonable range.

Insurance: China’s insurance sector has undergone reform and upgrade in both products and channels structures under the backdrop of asset side return and liability side pressures. The industry started to recover, good timing (near the bottom).

Logistics: focus on China’s consolidating competitive landscape in express delivery, less-than-truckload express, cold chain, integrated logistics (under-utilized rail and air transportation) and cross-border logistics. While logistics was a low-margin boring business, the space now has a strong tailwind of “smart” and “green” behind it.

Healthcare: the valuation of the healthcare industry in China has revert to a reasonable range due to the National Volume Based Purchase, which along with the ageing population and historically low birth rates present investors with some attractive investment opportunities.

All information contained in this publication is provided on a factual or general advice basis only and is not intended or be construed as an offer, solicitation, or a recommendation for any financial product unless expressly stated. All investments carry risks and past performance is no indicator of future performance. Before making an investment decision, you should consider your personal circumstances, objectives and needs and seek a professional investment advice. Opinions, estimates and projections constitute the current judgement of the author as at the date of this publication. Any comments, suggestions or views presented in this communication are not necessarily those of HALO Technologies, Macrovue or any of their related entities (‘we’, ‘our’, ‘us’), nor do they warrant a complete or accurate statement.

The opinions and recommendations in this publication are based on a reasonable assessment by the author who wrote the report using information provided by industry resources and generally available in the market. Employees and/or associates of HALO Technologies or any of the other related entities may hold one or more of the investments reviewed in this report. Any personal holdings by HALO Technologies or any of the other related entities employees and/or associates should not be seen as an endorsement or recommendation in any way.

The HALO Investment Research software (the Software) and www.halo-technologies.com (the Website) are created, operated and controlled by HALO Technologies Pty Ltd ACN 623 830 866 HALO Technologies Pty Limited ACN 623 830 866 is a Corporate Authorised Representative CAR: 001261916 of Macrovue Pty Limited ACN:600 022 679 AFSL 484264. MacroVue Pty Limited is a wholly owned subsidiary of HALO Technologies Pty Ltd. These companies are related entities with Amalgamated Australian Investment Group Limited ABN 81 140 208 288 (AAIG).

Get the latest insights and hot tips delivered right to your inbox

HALO Technologies Pty Ltd ABN 54 623 830 866 is a Corporate Authorised Representative No 1261916 of Macrovue Pty Ltd ABN 98 600 022 679 AFSL 484264. Macrovue Pty Ltd is a wholly owned subsidiary of HALO Technologies Pty Ltd.