THE PROBLEM

There are several challenges facing investors who are looking to generate reliable income streams to fund their lifestyle.

Persistent high inflation, slowing economic growth, and impending interest rate hikes have created difficult conditions for equities investors looking to build wealth while protecting their hard-earned capital.

Higher inflation has meant that traditionally safer income vehicles, such as bonds and term deposits, have become less attractive to investors looking to generate a high yield from their portfolios.

While equities remain a viable option for income through stocks that pay dividends, investors can often come undone by focusing on the wrong criteria when it comes to stock selection.

The average Australian dividend investor is obsessed with yield and rightly so. This is no wonder given the two structural issues that have permeated the Australian investing psyche over the past couple of decades. From the tax efficiency of franking credits together with the aging population moving into retirement it is no wonder that tax-efficient high yield securities have become the mainstay of many portfolios.

Many investors make the mistake of chasing high-yield, fully-franked Australian dividend stocks, neglecting the fact that it is the earnings that drive the ability of a company to pay dividends.

If earnings fall, it is likely the future dividend profile will come under pressure as well.

Simply searching for ASX stocks with high dividends is not enough if you are looking for reliable income.

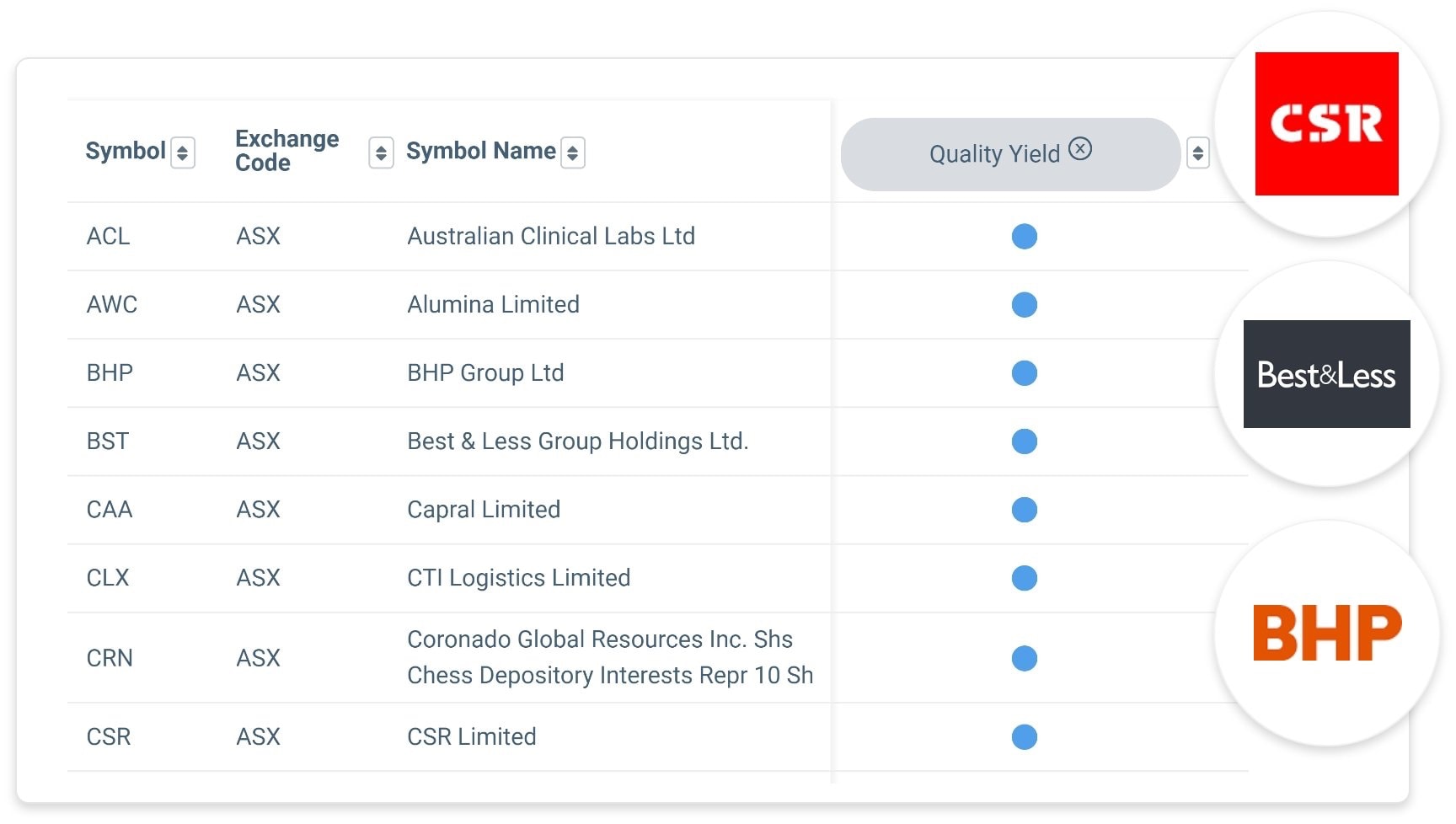

Our solution to this problem and how we find the best Australian dividend stocks is Quality Yield.

THE SOLUTION

THE SOLUTION

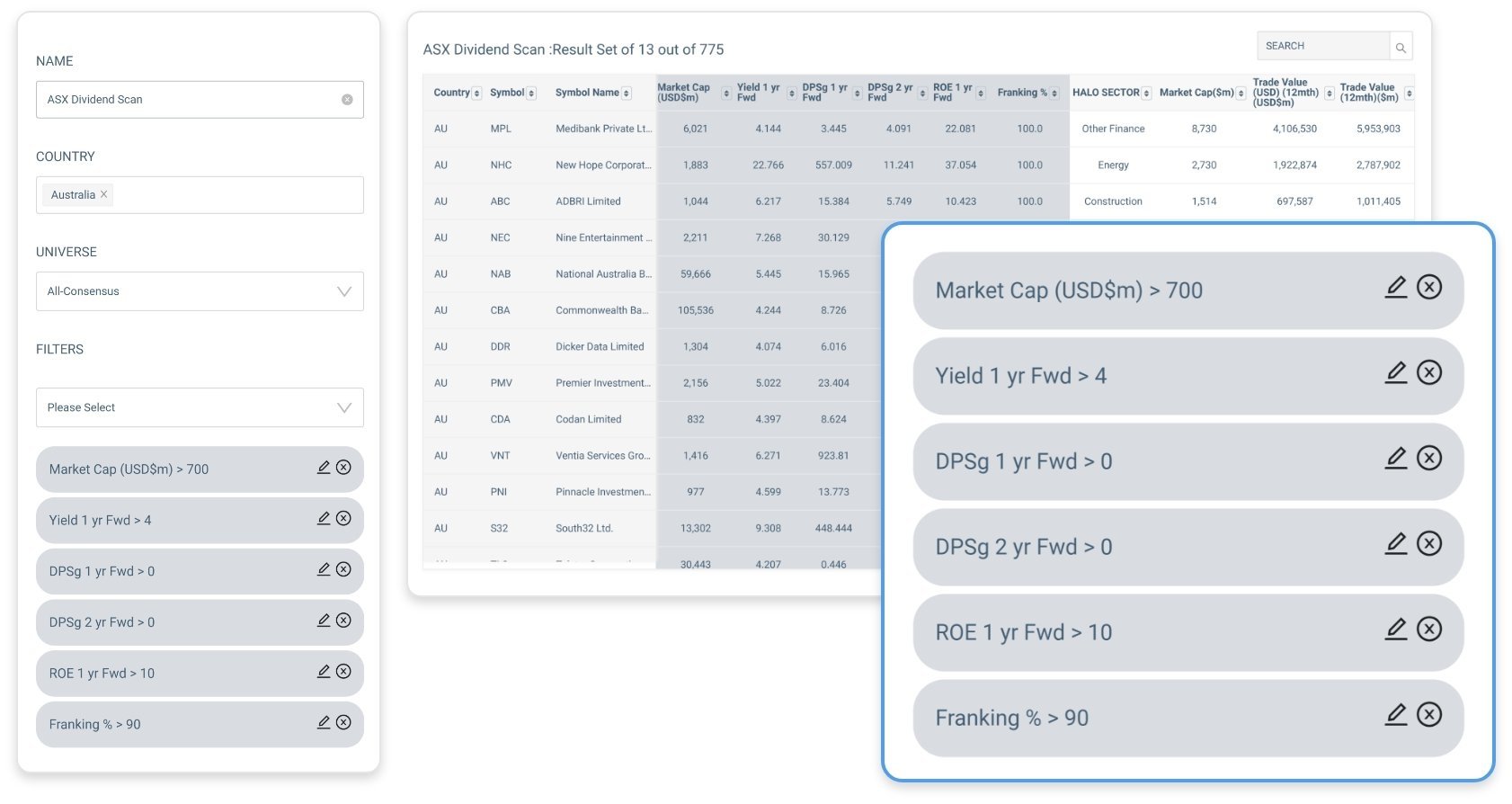

Focusing on larger companies

The Australian market has averaged around 4.5% over the past two decades. Above average yield is targeted.

It is imperative to grow your income stream. When DPUg turns negative, it is often the case a company’s shares are de-rated leading to capital loss defeating the purpose of having an equity portfolio which substitutes for traditional fixed income.

Low leverage which immediately EXCLUDES Banks and high leverage infrastructure companies.

This provides a quality factor to the notion of yield.

HALO Global is a global equities research and execution solution that has been designed by professional fund managers to help investors save time, find better opportunities and make smarter decisions for their portfolios.

Our solution brings institutional-grade tools, signals and monitors to self-directed investors who are serious about maximising their returns and growing their wealth.

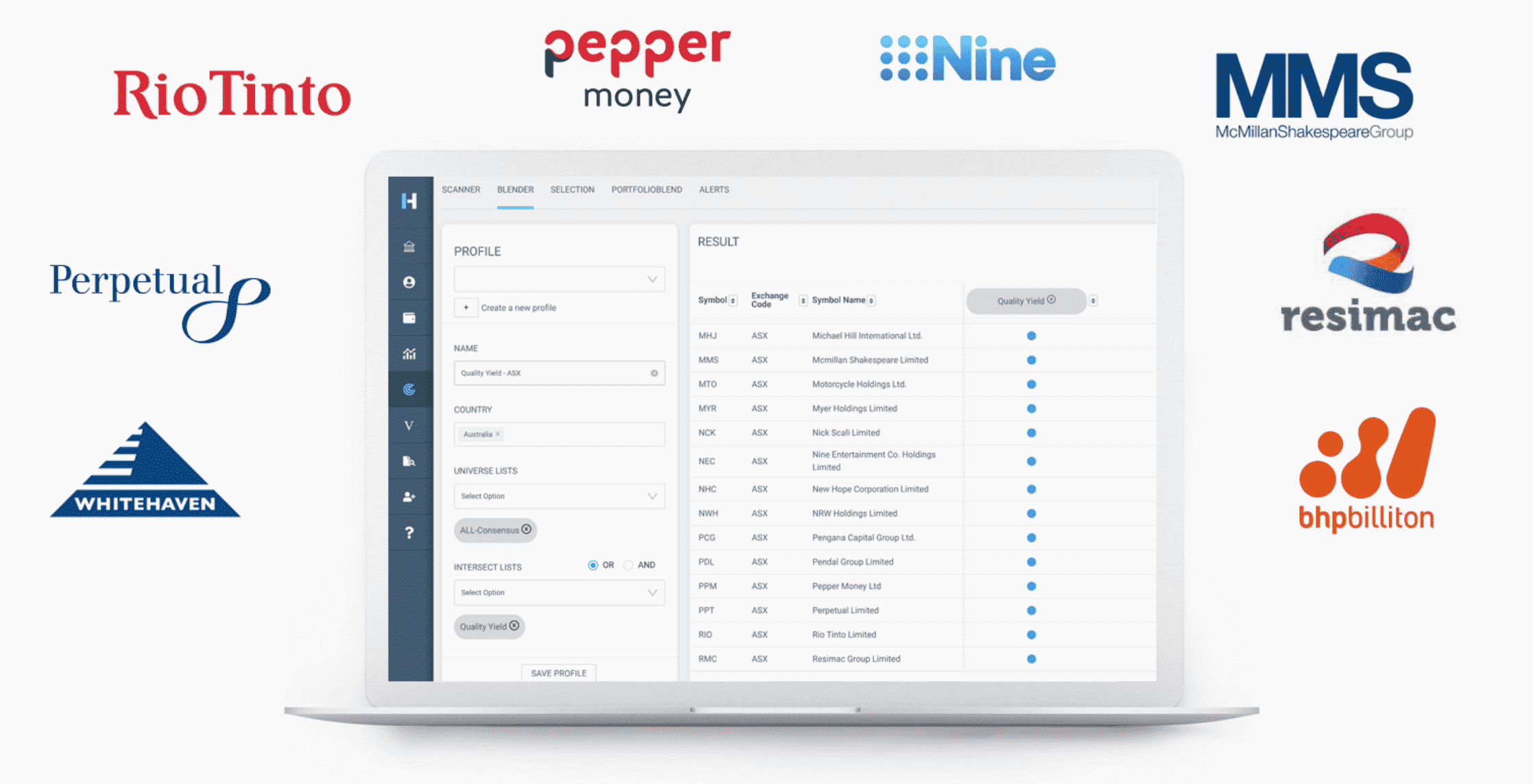

The Quality Yield Monitor is unique to HALO Global and can be applied to any market in the world and will identify the companies that currently match our Quality Yield criteria.

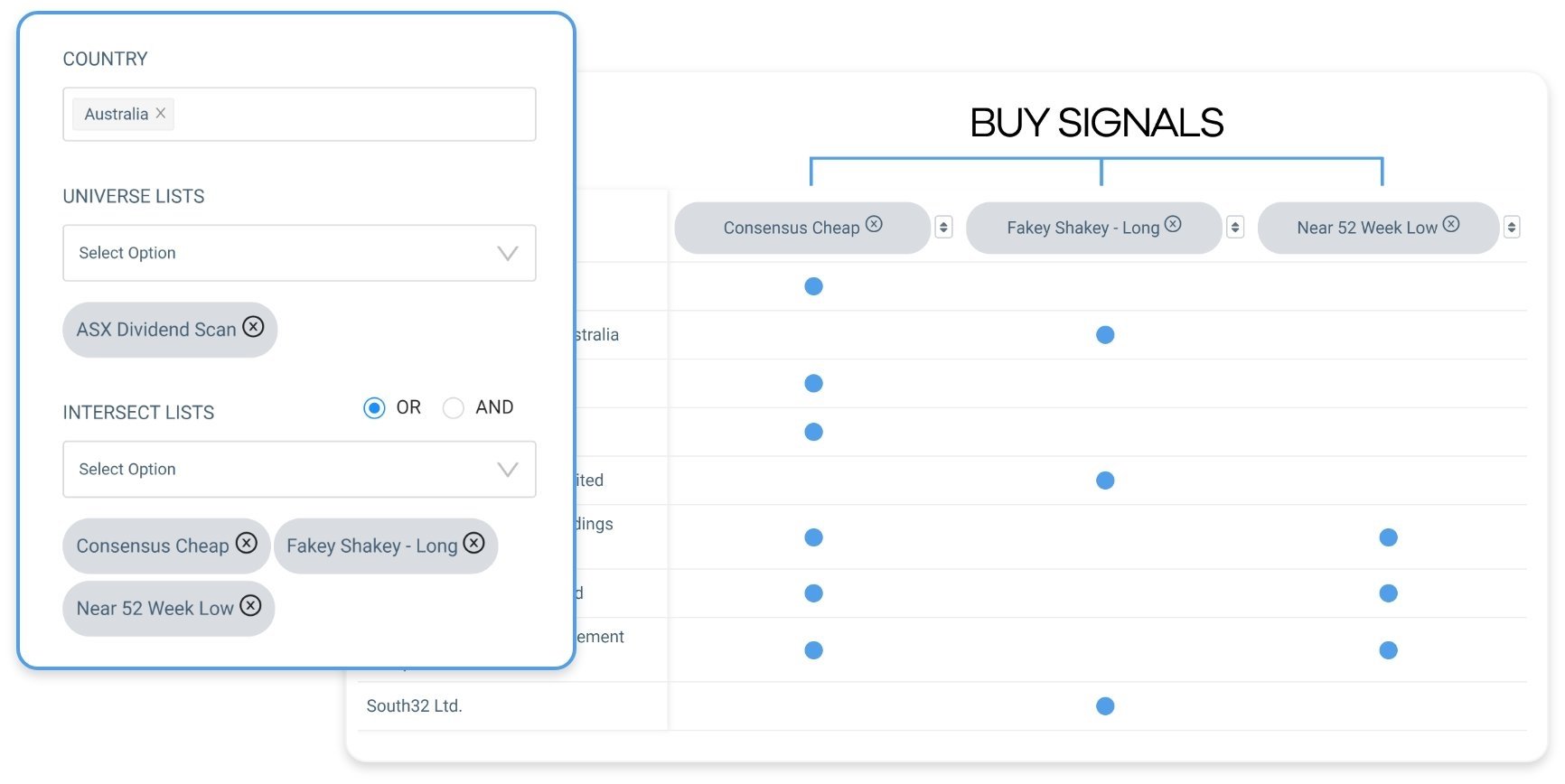

This list of reliable, income producing companies updates automatically with new opportunities as they become available and can be combined with our buy now signals to identify ideal entry and exit points.

WHY HALO

HALO Global gives investors unparalleled access to reliable global financial data.

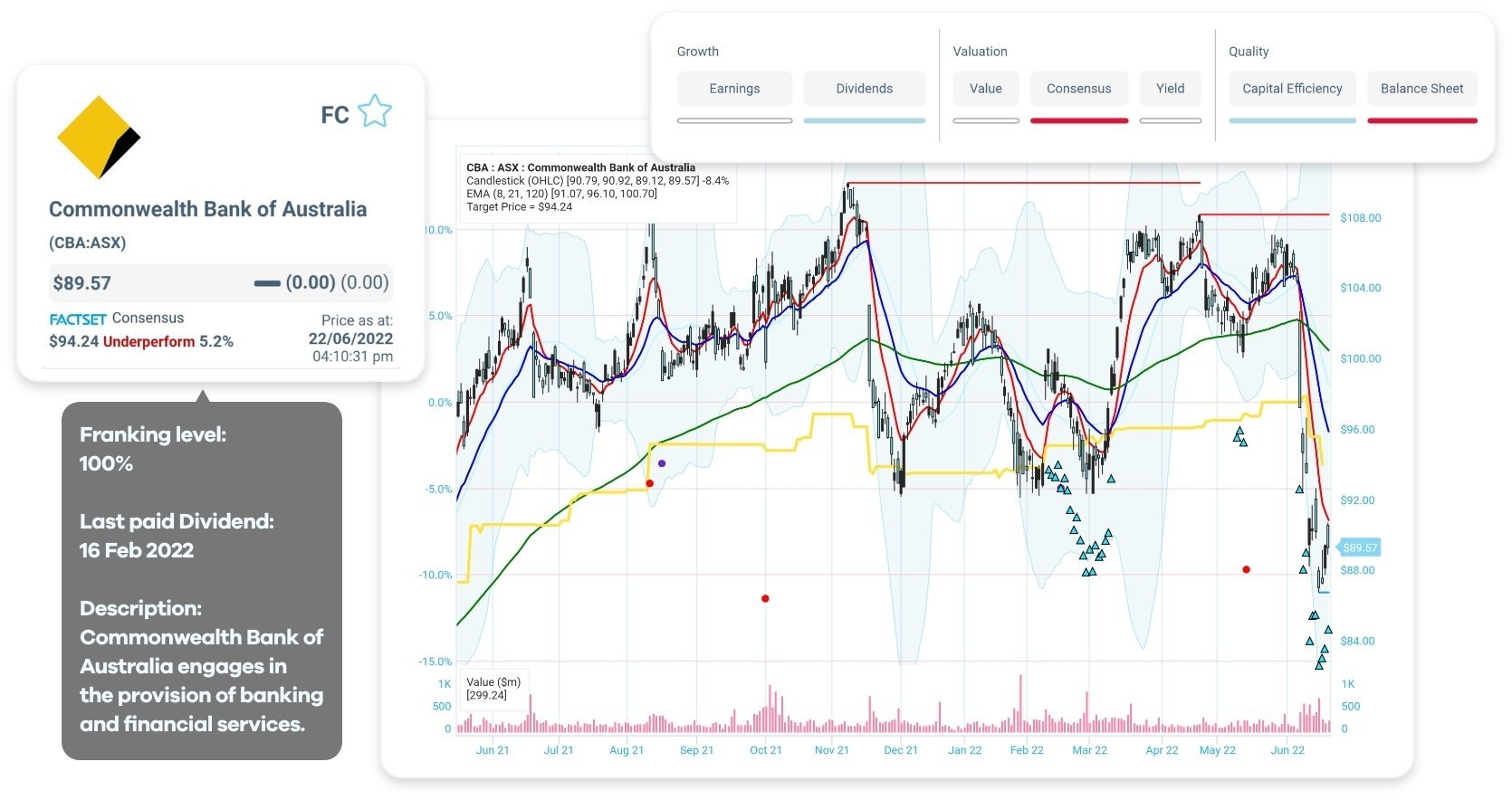

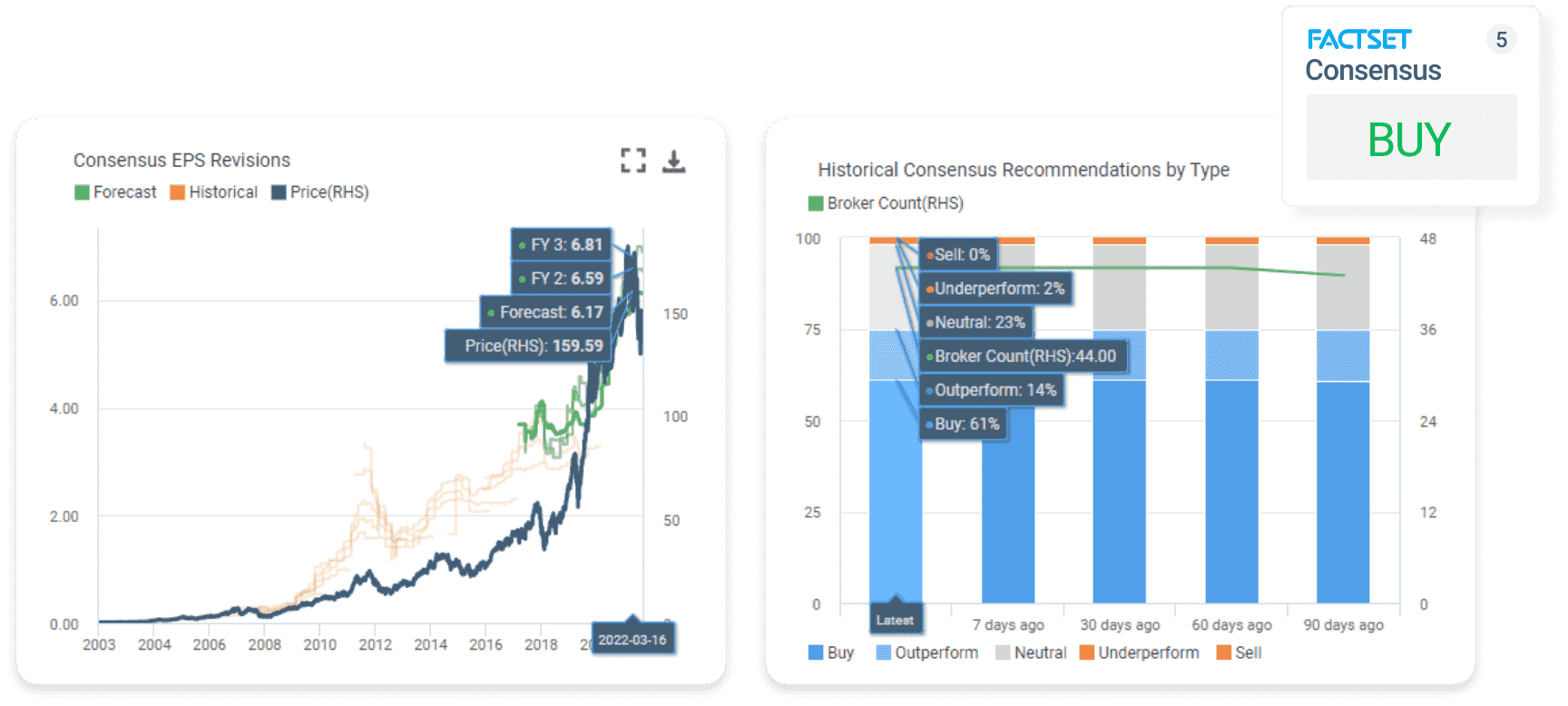

While other equities research solutions may only show a historical snapshot of a company’s financials, HALO Global is able to deliver more insights for investors with forecast data from the world’s biggest research firms and brokers.

See the historical performance of a company’s profit and loss, balance sheet, cash flow and more as well as how they are likely to perform in the future with predictive consensus data up to 3 years into the future.

HALO Global provides investors with low-cost access to the largest and fastest-growing companies around the globe.

With our solution, you can analyse and invest in over 35,000 securities across 30 different exchanges – including the ASX, NASDAQ, NIKKEI and more.

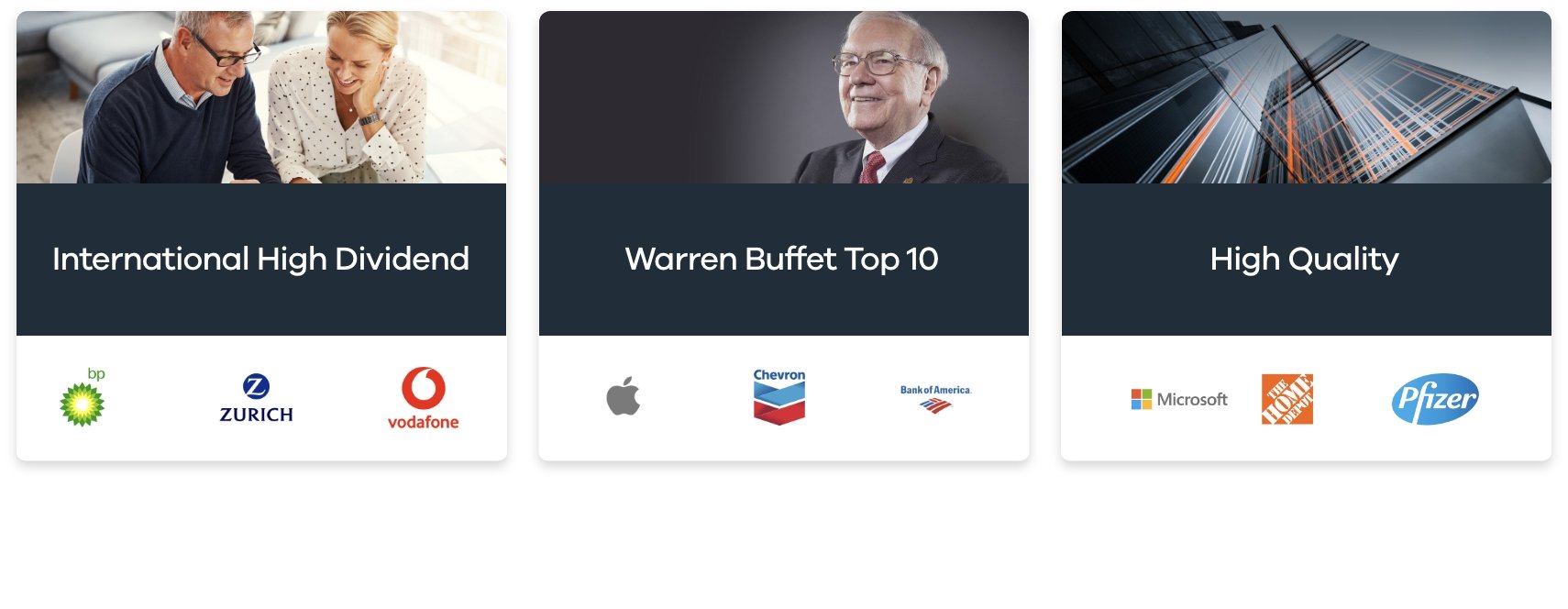

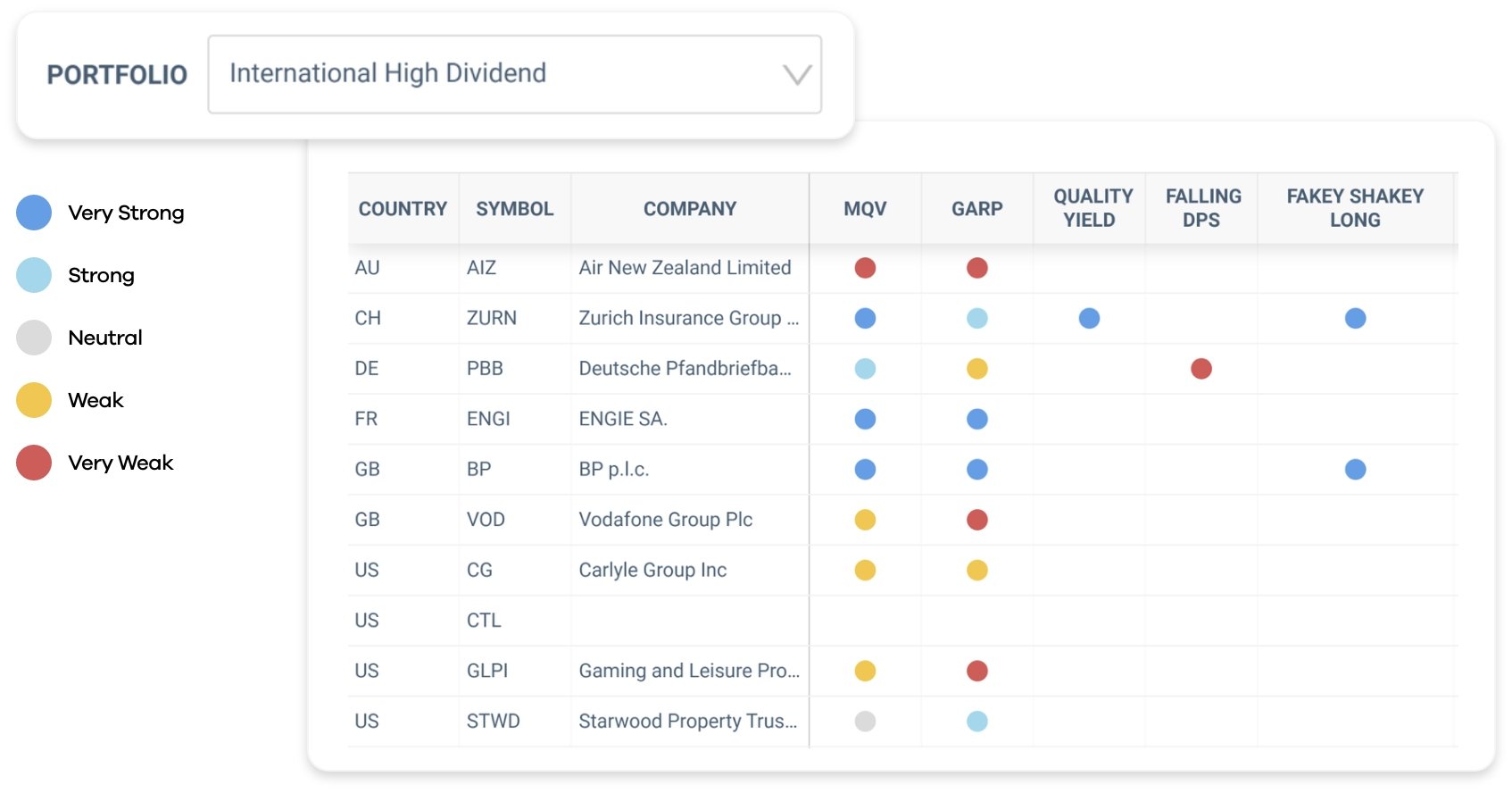

Not sure where to get started? Explore our 26 ready-to-invest share portfolios centred around the world’s biggest trends including International High Dividend, Artificial Intelligence, Warren Buffet Top 10 and more.

THE SOLUTION

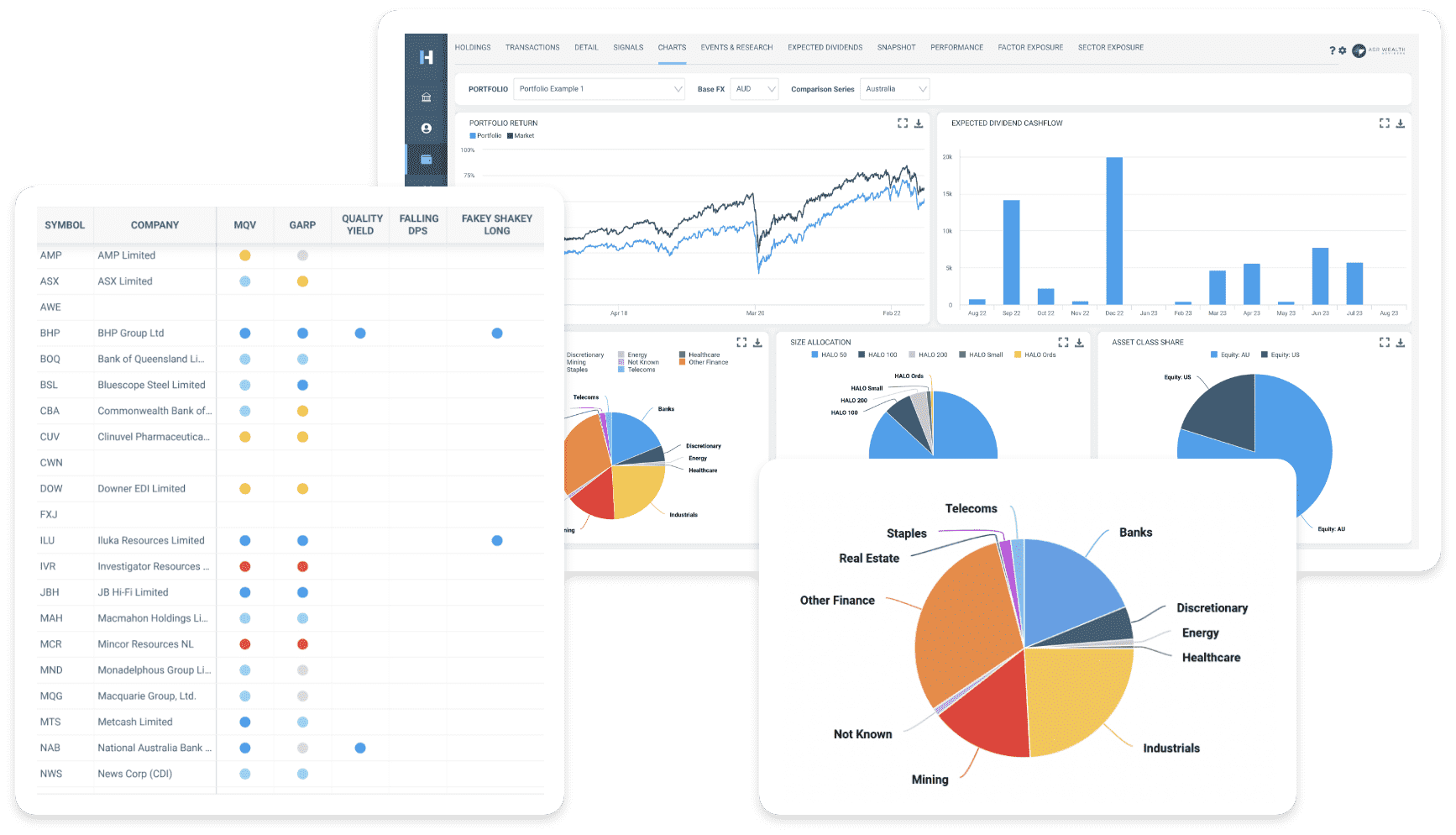

Truly understand the potential of a company with our market-leading charting interface developed by professional fund managers. Clearly visualize market expectations, signals, price profitability, dividends, franking credit levels and more on a fully-customisable chart.

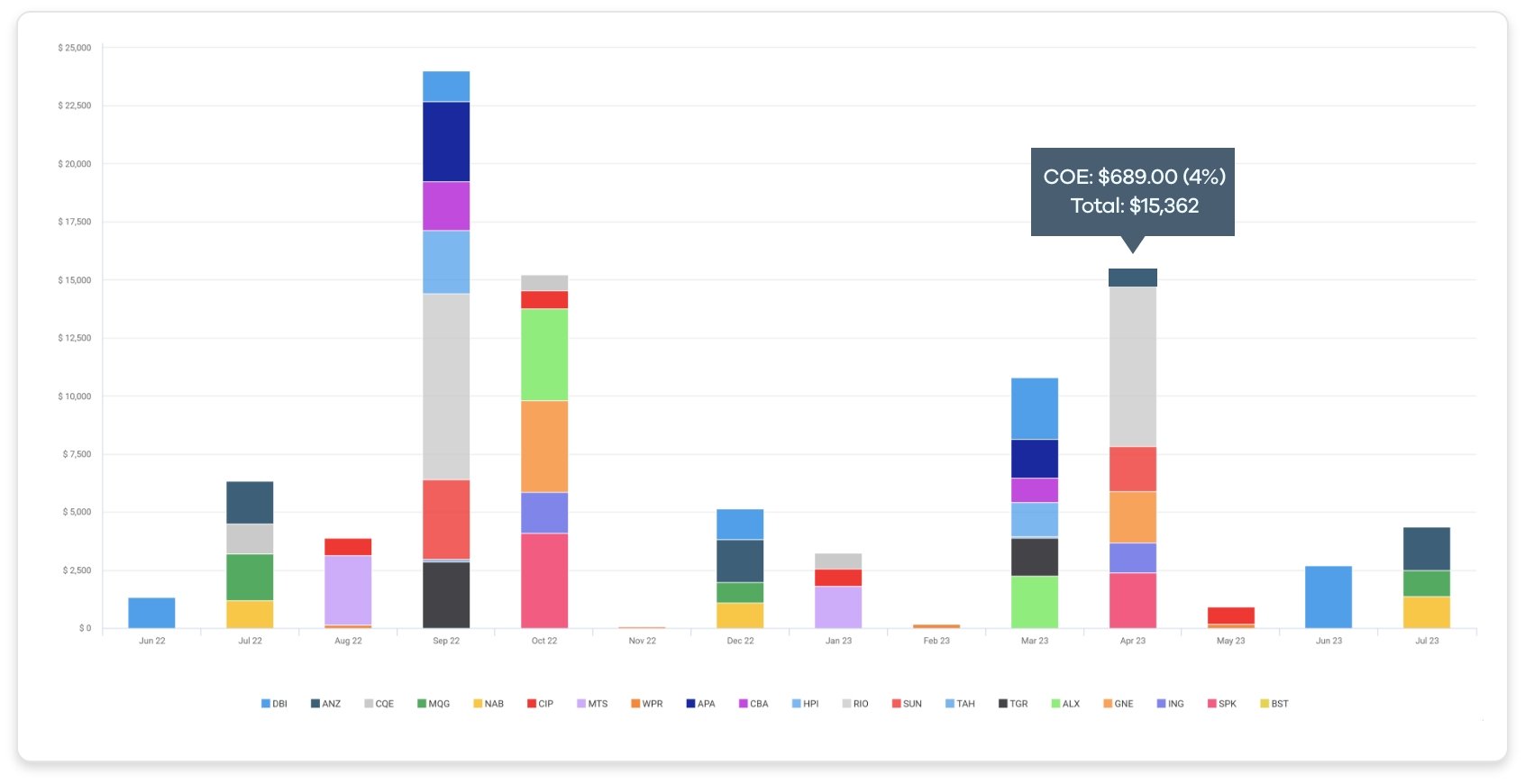

This feature is a must-have for all income investors looking to better manage their dividend cashflow. The Expected Dividends Chart calculates and visualises all of the dividend payouts you are likely to receive from your holdings and lets you know which month you can expect them on a rolling 18-month forecast.

HALO Global offers income investors two unique monitors to help find better opportunities and make smarter decisions.

The Quality Yield monitor is an automatically updating list of stocks that offer investors a minimum 5% dividend yield, show positive Dividend Per Share growth and have low leverage. This can help investors identify blue chip stocks that pay high dividends.

The Falling Dividends Per Share (DPS) monitor is a risk management tool for income investors and provides a list of companies that analysts expect to have negative Dividend Per Share growth over the next two years.

Looking for reliable fully-franked, high-yield dividend stocks? HALO Global has got you covered.

Scan entire exchanges in seconds for opportunities that match your investment goals. Turn your scans into watch lists that update daily with new companies that match your criteria. HALO Global can help you find Australian blue chip shares with good dividends.

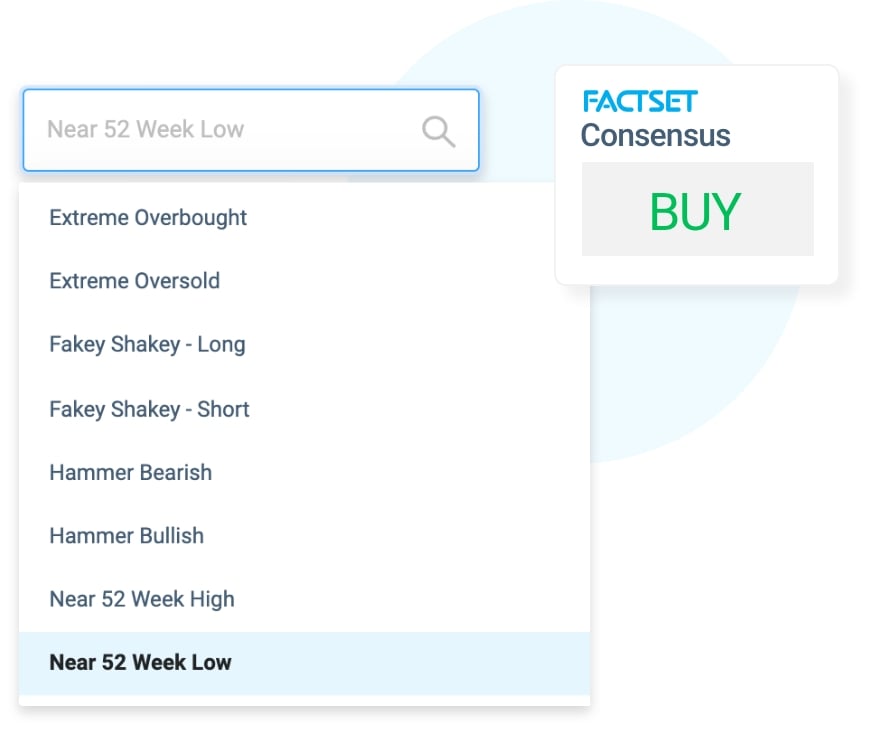

Combine your scans with our comprehensive list of signals, monitors and universes to easily identify double, triple and even quadruple-blessed opportunities for your portfolio.

Unique to HALO Global are our ready-to-invest thematic portfolios, known as Vues. Each portfolio has 10 hand-selected companies centred around an investment trend or theme.

The International High Dividend Vue, for example, is a list of international blue chip stocks that have a high yet reliable dividend yield hand-selected by our investment committee.

Designed by professional fund managers, HALO Global makes institutional-grade signals and monitors accessible to everyday investors. Easily identify potential entry and exit points on the companies you are interested in with easy to understand buy and sell signals.

Invest with confidence with aggregated Broker Consensus Recommendations and EPS revisions from the world’s biggest research firms.

HALO Global has been designed to help investors make smarter decisions for their portfolios. Compare your performance against a variety of benchmarks. See which shares are the major contributors to your portfolio performance and which shares are on the decline. Better understand your portfolio’s asset and sector allocation and how they work towards your investment goals.

HALO Global is a equities research and execution solution that allows users to analyse and invest in over 35,000 shares and ETFs across 30 exchanges.

HALO Global has been designed by professional fund managers to help investors save time, find better opportunities and make smarter decisions for their portfolios.

HALO Global has been designed by professional fund managers to help investors save time, find better opportunities and make smarter decisions for their portfolios.

If you are serious about improving your performance and growing your wealth, HALO Global can help.

Important:

Before making an investment decision, you should consider your personal circumstances, objectives and needs and seek a professional investment advice.

HALO Global is offered by HALO Technologies Pty Ltd ABN 54 623 830 866 which is a Corporate Authorised Representative No 1261916 of Macrovue Pty Ltd ABN 98 600 022 679, the holder of an Australian Financial Services Licence No 484264. Please read our Financial Services Guide for further information. We are also one of the few Australian companies to be registered as a Qualified Intermediary with the IRS in the U.S.

We have strong governance procedures in place and the management team has several decades of experience with leading fund managers, brokerages, and investment banks. Please see our About Us page for more information.

There are many great ideas out there. Finding discerning ways to turn those ideas into equity investments can be daunting when you have reams of data and information to wade through and limited access to professional analysis.

At HALO, we do the hard work for you. Our team is dedicated to constructing portfolios of 10 stocks each, called Vues, that give you exposure to a selected theme, while also allowing you the flexibility and control to fine-tune as you go.

We are targeting do-it-yourself investors looking for a new way to invest a portion of their savings and engaged in deciding how best to allocate their money. Our users demand the transparency and control that much of the superannuation industry doesn’t provide.

We are committed to looking beyond our own beautiful shores to opportunities in the world’s largest and most dynamic economies so that you don’t miss investing in the next chapter of China’s growth story or the U.S. recovery or the Internet of Things that’s reshaping our lives. The majority of our Vues are blind to borders, looking only for the stocks that best express a theme. So, not only are you diversified through multiple companies, you are also geographically diversified.

Come join us and explore a new world of ideas.

Unfortunately, we cannot accept US or Canadian Citizens/Residents for this product.

No. We only accept Australian Dollars. We are working on catering for USD, GBP and Euro deposits in the coming months.

Can I transfer positions to/from my HALO account?

Absolutely! Most stocks can be transferred to your HALO account. You either hold stocks at a broker (broker-sponsored) such as CommSec or nabtrade, or the shares are controlled by the issuer (issuer-sponsored) and held via a share registry such as Boardroom (added this as that’s where HALO shares are held), Computershare or Link Market Services. There may be some exemptions such as micro-cap stocks. If you would like to initiate a transfer of your positions in or out of your account you can complete the forms below to and email it to us support@halo-technologies.com.

Alternatively, if you would like to discuss your options regarding a position transfer, please do not hesitate to contact us.

What is the process of a position transfer?

For issuer sponsored holdings we need an up-to-date holdings statement detailing the ticker, quantity of shares held, the registry and your SRN/HIN where applicable and a signed position transfer form which you can request from support@halo-technologies.com . We will then send this to our custodian and the positions will settle in your account.

For broker sponsored holdings you need to complete the same forms above detailing the stocks you wish to transfer, your account number at the sending broker (you will need to provide two if you hold domestic and international shares), your broker information including a contact email and your signature granting us permission to initiate the transfer. We will send this signed form to your current broker and to our custodian. Once our request matches with your broker's instructions the stocks will settle into your account.

First, you will need to complete a trading account application.

To complete a transfer for Australian Dollars, you can request a deposit on trader. We will provide you with the secure transfer details for HALO trust account. We will notify you via email when your funds are available for investing.

To complete a transfer for any other currency, please contact HALO Support. We don’t support other CCYs yet.

Yes, you must be an Australian resident for tax purposes. The simplest way to think about this is whether you submit an Australian tax return?

The Australian Taxation Office provides more information if you have unique circumstances. The information can be found here: https://www.ato.gov.au/Individuals/International-tax-for-individuals/Work-out-your-tax-residency/

We offer individual, joint, self-managed super fund (“SMSF”), company, and trust accounts.

The process is fully online. All you need to do is fill in our online form with your personal information. We need to collect this in order to meet our legal obligations for anti-money laundering regulations.

It only takes about 5 minutes to complete the application for an individual account and you can always save and come back if you don’t have all the information on you.

We will email you as soon as your account is ready to trade.

Absolutely. Head to our website to activate your free 7-day trial of HALO Global. You will get access to all features and data sets for the trial period.

At the end of the trial, you can still access your HALO Trading account which allows you to invest in over 35,000 shares and ETFs.

A HALO Trading account is free to create an offers competitive brokerage for global equities.

A step-by-step guide to setting up your HALO Trading Account as a Trust Account.

Part A - Setting up application login details

Step 1: Go to https://app.halo-technologies.com/login

Step 2: Fill out the fields it requires. Note: for your password it needs to be a minimum of 8 characters, one capital and one number.

Step 3: Click ‘Join HALO’. An email will be sent to you title "Trading Application Approval required". Click on "Finalise Trading Account application".

Step 4: You will be prompted to login using the username and password provided. Please re-set your password and log out.

Step 5: Login to your HALO account with your username and new password.

Step 6: Click on ‘Apply Now’ to navigate to Trading Application. You can also click ‘Complete a trading application’.

Part B - Setting up as a Trust Account

Scroll down and select the type of trust:

approval by clicking ‘submit application’.

If you have any questions, please contact Client Services on 1300 720 292.

Part A - Setting up application login details

Step 1: Go to https://app.halo-technologies.com/login

Step 2: Fill out the fields it requires. Note: for your password it needs to be a minimum of 8 characters, one capital and one number.

Step 3: Click ‘Join HALO’. An email will be sent to you title "Trading Application Approval required". Click on "Finalise Trading Account application".

Step 4: You will be prompted to login using the username and password provided. Please re-set your password and log out.

Step 5: Login to your HALO account with your username and new password.

Step 6: Click on ‘Apply Now’ to navigate to Trading Application. You can also click ‘Complete a trading application’.

Part B - Completing your Individual Account application

Step 1:

Your application will then be sent off for approval which will take approx. 1 business day.

Part A - Setting up application login details

Step 1: Go to https://app.halo-technologies.com/login

Step 2: Fill out the fields it requires. Note: for your password it needs to be a minimum of 8 characters, one capital and one number.

Step 3: Click ‘Join HALO’. An email will be sent to you title "Trading Application Approval required". Click on "Finalise Trading Account application".

Step 4: You will be prompted to login using the username and password provided. Please re-set your password and log out.

Step 5: Login to your HALO account with your username and new password.

Step 6: Click on ‘Apply Now’ to navigate to Trading Application. You can also click ‘Complete a trading application’.

Part B - Completing your SMSF Account application

Step 1:

. your industry (e.g. retired; retail),

primary source of Funds (e.g. employment income; investment income if retired)

Primary source of Wealth

Complete steps 11-15 for any other applicants.

Accept the acknowledgements at the end of the page and sign with your name as a digital signature. Given that HALO is an international investing platform and will be used to access US markets through Interactive Brokers they must confirm that you are not a US resident or taxpayer, or a resident of a country currently sanctioned by the US (e.g. North Korea).

If you would like further assistance, please contact client services on 1300 720 292.

Step by step guide to setting up your HALO Trading account as a Company account.

Part A - Setting up application login details

Step 1: Go to https://app.halo-technologies.com/login

Step 2: Fill out the fields it requires. Note: for your password it needs to be a minimum of 8 characters, one capital and one number.

Step 3: Click ‘Join HALO’. An email will be sent to you title "Trading Application Approval required". Click on "Finalise Trading Account application".

Step 4: You will be prompted to login using the username and password provided. Please re-set your password and log out.

Step 5: Login to your HALO account with your username and new password.

Step 6: Click on ‘Apply Now’ to navigate to Trading Application. You can also click ‘Complete a trading application’.

Part B - Setting up as a Company Account

or the Sole Director where appropriate.

Provide the details for the company including: (Bold are required, and you should make sure you have these when you start)

Fill out your personal details

Your address is your residential address, cannot be a PO box but can enter that as

mailing address later.

When you reach the Country of Citizenship/Birth section remember to click the country which

will appear in the drop-down menu.

Should require further assistance please contact client services on 1300 720 292.

Step by Step guide to setting up your HALO account as a Joint account.

Part A - Setting up application login details

Step 1: Go to https://app.halo-technologies.com/login

Step 2: Fill out the fields it requires. Note: for your password it needs to be a minimum of 8 characters, one capital and one number.

Step 3: Click ‘Join HALO’. An email will be sent to you title "Trading Application Approval required". Click on "Finalise Trading Account application".

Step 4: You will be prompted to login using the username and password provided. Please re-set your password and log out.

Step 5: Login to your HALO account with your username and new password.

Step 6: Click on ‘Apply Now’ to navigate to Trading Application. You can also click ‘Complete a trading application’.

Part B - Setting up a Joint Account

This is required by law.

Our data feed shows the last price for each of your positions as at the close of the relevant stock market. As we operate in a number of international markets, there will be a delay in the performance data based on when the relevant market closes. For example, you will often see your performance data for US stocks in the afternoon Australian time, after the US market closes - however your European stocks will have updated data available in the morning Australian time as European markets are open earlier relative to US markets.

The aggregate measure of Growth for a Vue is calculated using reported past and future earnings growth estimates. One notch signifies lower growth while five notches reflects higher growth potential.

The aggregate measure of Valuation for the Vue is calculated using relative values measures such as free cash flow yield, earnings yield, and other empirically tested metrics. One notch signifies relative expensiveness while five notches signifies relative cheapness.

The aggregate measure of Risk for the Vue is calculated using the standard deviation of the share prices of the underlying shares in the Vue over the past 12 months. One notch signifies a narrower share price trading band of the constituent stocks in the Vue, and consequently lower risk, while five notches signifies higher risk (and wider share price trading band).

One of the best features of HALO is the display of performance. We provide returns data in both dollar and percentage terms.

The performance of your overall portfolio or a Vue you have invested in is measured as:

Capital Gain/Loss + Income + Currency Gain/Loss = Total Return.

The meaning of each term is outlined below:

Capital Gain/Loss – The change in dollar value of the underlying holdings calculated over relevant period in local currency converted to AUD based on daily mid spot rate at 4:00pm (GMT). This may also be calculated as a percentage.

Income – The total cash dividend payments received over relevant period in local currency converted to AUD based on daily mid spot rate at 4:00pm (GMT). This may also be calculated as a percentage.

Currency Gain/Loss – The dollar return derived from changes in the valuation of the underlying holdings due to exchange rate movements over relevant period converted to AUD based on daily mid spot rate at 4:00pm (GMT). This may also be calculated as a percentage.

Total Return – The dollar sum of Capital Gain/Loss, Income, and Currency Gain/Loss. This may also be calculated as a percentage.

Portfolio performance is calculated by Sharesight. Performance calculation methodology can be found here.

Spinoffs are corporate manoeuvres where a company separates a part of its business.

Shareholders in the parent company continue to hold this company but also receive shares in the new entity.

The cost basis of the parent company is reduced by the value of the spinoff and the cost basis for the spinoff stocks is set at their market value on the day of the event.

Stocks are merged to form a smaller number of effectively more valuable shares.

There will be a reduction in the quantity of shares, but the value of your total holdings stays the same.

It is not a tax event, but your cost price will be adjusted for the purpose of tax reporting.

A merger occurs when two existing companies combine into one new company or when one company acquires another.

When a merger occurs, the original stock will cease to exist. According to the ATO, the capital proceeds for the original shares are the total of the market value of the new shares received at the time of the takeover, and the money received (if any). The cost of acquiring the shares in the takeover or merged company is the market value of original shares at the time the other shares are acquired, reduced by any cash proceeds.

You will cease to hold a specific stock and be issued with a different stock or with cash.

If a company in which you owned shares was taken over and you received new shares in exchange for your original shares, you may be entitled to a scrip-for-scrip rollover. The rollover allows you to defer paying CGT until a later CGT event happens (for example if you later dispose of the shares you acquired in the takeover). The rollover doesn't apply if you made a capital loss. For the purpose of tax reporting we report all mergers as capital gain events and leave it to the discretion of the shareholder to determine if they are eligible for scrip-for-scrip rollover.

When a company issues new shares to shareholders in proportion to their current holdings.

There will be an increase in the quantity of shares, but value of your total holdings stays the same.

It is not a tax event, but your cost price will be adjusted for the purpose of tax reporting.

The shareholder is issued a dividend which then gets invested in the given stock.

Rather than your cash holdings increasing you will reinvest this into the stock in question.

The tax implication is a modified cost basis and the dividend reported as income.

This corporate action involves shares being bought back by the company or an investor and are a tax event.

A stock buyback, also known as a "share repurchase", is the process by which shares are bought back from the open market. There are two types:

Tender: A tender offer is when an investor proposes buying shares from every shareholder of a publicly traded company for a certain price at a certain time. The investor normally offers a higher price per share than the company’s stock price, providing shareholders a greater incentive to sell their shares.

Open Market: a company has to buy shares on the open market, just like an individual investor would, at the market price.

If you choose to sell your shares you will no longer hold those stocks and you will be issued with cash in return.

The selling of shares in a buyback is a tax event and the income is classified as a capital gain (or loss).

A rights issue is an issue of rights to a company's existing shareholders that entitles them to buy additional shares directly from the company in proportion to their existing holdings, often at a discount to the market price. Rights are often transferable, allowing the holder to sell them on the open market. You have 3 options when considering a rights offering:

If you choose to subscribe you will be able to purchase additional shares, often at a discount.

The actual purchase of rights is not a tax event, however, as there is often a discounted price your overall cost basis may be altered. The sale of rights is a tax event and you will need to report this income as capital gains.

Corporate actions are offers issued by a publicly traded company that affects the securities issued by a company.

Corporate actions are offers issued by a publicly traded company that affects the securities issued by a company. They may have an impact on reportable capital gains and income. There are two types of corporate actions: voluntary and mandatory. Voluntary corporate actions mean shareholders can elect to participate. These may include rights issues, buybacks and dividend payments. Mandatory corporate actions are automatically applied as they do not provide shareholders with the option to participate or not participate. These may relate to company restructure, such as mergers.

Most corporate action instructions need to be submitted 7 days before the expiration of the offer.

Dividends can be in the form of cash or stock. Cash dividends are payments made by the company to shareholders in the form of cash. Stock dividends are new shares given to shareholders.

Cash dividends will increase your cash holdings and may provide a regular income on investment. Stock dividends provide shareholders with the choice to keep the stock or change it into cash.

Dividends are a form of income and must be reported in annual tax returns.

Dividends from US-based Publicly Traded Partnerships.

US Tax withholding on distributions from Publicly Traded Partnerships (a type of limited partnership) is withheld at 37% (2018) as this is earned income in the US.

We give you the ability to view currency, dividend and share capital gains as well as prepare hassle-free end-of-year tax reports for your holdings. However, we do not offer any tax advice and you are responsible for your own tax filings.

When you sell your shares, the proceeds will be credited to your account after the settlement date. Settlement dates vary generally between two to three business days, depending on the jurisdiction involved. In unusual circumstances, market conditions can sometimes lead to an increase in settlement time. By default, the funds will be left in local foreign currency after settlement of trades. If you want to convert the funds to Australian Dollars, you can instruct us to do so on your behalf.

Yes, HALO does enable you to place limit orders and stop-loss orders.

We enable the cancellation of limit orders and there is no penalty charge.

Trading international shares is a complicated endeavour. There are several moving parts for a transaction, including:

To keep your experience as simple as possible, HALO builds in a buffer into the amount you’d like to invest in order to account for movements across each of the factors outlined above. This buffer is designed to maximise the amount available for you to invest.

HALO’s algorithm attempts to perform an equal allocation across all the selected shares, essentially trying to split the notional amount invested equally across the shares. Where this is not possible, as a result of minimum investment sizes, liquidity constraints, or other factors, our system will make its best effort to achieve an equal allocation in dollar terms across all the selected shares.

If you wish to change the allocation from what the system has calculated, you may go to the underlying shares and change the relevant quantity.

HALO enables you to trade in the following countries:

North America

Europe

Asia Pacific

Yes, you can purchase any one of the approximately 20,000 stocks we have on our database.

You can also customise any Vues to remove individual stocks before purchase, and if you have already purchased a Vue but want to sell just one stock, you can do that as well.

The Vues page shows the Vues that are available for investment. You can explore each individual Vue to find the research thesis behind the Vue, detailed metrics and the list of shares. You have the choice to modify the Vue or if you’re happy with the current share picks, you can click to buy the Vue from this page.

Selecting Buy Vue will take you to the allocation step. By default, the allocation page displays the minimum possible investment in the Vue. You can choose any amount above the minimum and our allocate feature will attempt to provide an equal allocation in dollar terms across each of the shares automatically. If you wish to construct your own allocation, you can modify this accordingly.

There is also an option to select order type. Currently, you can choose either Market Order or Limit order. The default is set to Market Order.

Once you’re happy with the Vue, select proceed to confirm. This final step is designed to ensure that no inadvertent errors are passed through to the market for execution. Once you have confirmed your order, our system will acknowledge that it has received the order and then send it to the market for execution. You will receive a fill confirmation by e-mail once the trade has been executed.

ASX-listed share prices are updated every 20 minutes. U.S-based shares are updated every 60 minutes. All other prices are based on previous day closing prices which are converted into Australian Dollars.

ADRs allow U.S. banks to purchase a bulk lot of shares from a foreign company, bundle the shares into groups and reissue them on U.S. stock markets.

American Depositary Receipts (ADRs) are stocks that trade in the U.S. but represent a specified number of shares in a foreign corporation – such as Alibaba (BABA). Like regular U.S stocks, ADRs are bought and sold on U.S. markets. They also trade in U.S. dollars and clear through U.S. settlement systems.

ADRs were developed because of the complexities involved in buying shares in foreign countries and the difficulties associated with trading at different prices and currency values. ADRs allow U.S. banks to purchase a bulk lot of shares from a foreign company, bundle the shares into groups and reissue them on U.S. stock markets – namely, the New York Stock Exchange and NASDAQ.

Source: Investopedia

When placing a trade on a Vue or an individual stock HALO will allocate 5% of your available capital at the time to a buffer.

This buffer ensures that the order will be filled in the event that there are any currency movements while the trade is being executed. Market orders on ASX listed stocks will also attract the buffer to ensure that the order is executed successfully in the event of price movements. The buffer amount will be ‘blocked’ while the trade is waiting to be executed and any unused portion will be unblocked once the order is filled.

For example: If you have $10,000 in funds in your HALO cash holdings only $9500.00 will be available to place a trade.

The brokerage fees that HALO provides is an estimated value only. It is impossible to know the final amount invested, and the exchange rates achieved, until the trade is actually fulfilled. Unless in times of extreme volatility, the estimate and actual fees should be very similar.

In addition to fees charged by HALO, transactions may be subject to taxes and duties from foreign exchanges and governments. While we make our best efforts to keep these charges estimated, it may be that fee structures change without our knowledge.

No, we don’t charge anything extra for customising or creating your own Vue.

We do not charge any Custodial fees.

The cost for any transactions in a Vue is simply the sum of the cost of the individual transactions whether they are purchases or sales.

When buying or selling shares, HALO charges brokerage and currency conversion fees for each transaction. There may be additional taxes and fees charged by exchanges and countries in foreign jurisdictions which we pass on to you.

If you are investing in our Vues, you will be charged a research fee of a research fee per annum (calculated daily and charged monthly) on the market value of the holdings in the Vue. This is in addition to the standard brokerage and currency conversion fees for any buy or sell transactions.

An annual platform access fee is also payable.

Vues are reviewed every 3 months and updated if necessary. We will notify you of changes, if any. You have the option to follow through and implement the changes in your Vue, but we do not automatically rebalance on your behalf. Once you have purchased a Vue, you have complete control over how the Vue is managed, meaning you can decide to change the allocations to something that may better suit your personal circumstances, or remain invested in better performers over time.

We cannot provide you personal advice since we do not know your circumstances and are not licensed to do so.

However, we believe that investing in thematic Vues should be part of a broad investment strategy, where exposure to Vues gives your added diversification to your existing portfolio of assets.

HALO enables you to invest in portfolios of 10 shares each. Holding more shares reduces your risk relative to holding just a single company. This is because companies can operate in different parts across the value chain, in industries, and in different countries at different stages of the economic cycle. Each of these factors spreads out your risk so your portfolio becomes less sensitive to events in any one company, industry or geography.

The stock trading exchanges we work with may require a minimum trade amount, or minimum quantity per shares. When you purchase a Vue, we will tell you what the minimum amount required is.

Unlike ETFs and managed funds, Vues give you full transparency and you can add/remove shares in a Vue. While we do recommend shares in Vues and provide regular updates to the recommendations, we do not manage your portfolio for you. You will always be in full control of your investment.

When you invest in Vues, you are the beneficial owner of the individual shares, unlike managed funds and ETFs. Hence you may also receive tax benefits since tax gains and losses are not shared with other investors in a pooled vehicle.

Also, unlike index tracking ETFs, we pick stocks that we believe are likely to outperform others with exposure to the theme.

HALO constructs Vues designed around a theme using our in-house team of investment experts that have extensive experience in financial markets with institutions such as AMP, Perennial, Legal & General, Bank of America Merrill Lynch and Putnam Investments.

We also let users create and invest in their own Vues.

A Vue is a portfolio of 10 professionally-selected shares that align to a specific market, industry, trend, theme or investment style.

A Vue is simply a basket of 10 professionally-selected shares that provides exposure to a specific market, industry, trend, theme or investment style, e.g.:

Unlike an ETF or managed fund, when you invest in a Vue you are actually purchasing shares in the 10 recommended companies and therefore become the beneficial owner of the shares. This provides you a level of control and transparency not offered by ETFs and managed funds.

Vues can been seen as an alternative to managed funds and ETFs, and may appeal to investors who wish to have more control and transparency when it comes to their investments.

Vues offer the following features and benefits:

Your initial cash deposit is received in HALO’s trust account at ANZ. We move this cash balance to Interactive Brokers within two business days.

If we are acquired or go public, your portfolio and funds held with us will remain secure and you will, as at any point, have the ability to close your HALO account, sell your holdings and withdraw your savings.

In the unlikely event we close, which we don’t foresee, we will give you the choice of transferring your positions and cash to another broker.

We have developed an extremely secure infrastructure with several layers of security. All data is encrypted at rest and in transit, is protected by firewalls, and is backed up regularly.

HALO is operated by HALO Technologies Pty Ltd (ABN 54 623 830 866) and holds an Australian Financial Services Licence (484264) issued by ASIC. Please read our Financial Services Guide for further information. We are also one of the few Australian companies to be registered as a Qualified Intermediary with the IRS in the U.S.

We are well funded by publicly listed institutions such as AMP, and venture capitalists such as H2 Ventures and Gatica Investments.

We have strong governance procedures in place and the management team has several decades of experience with leading fund managers, brokerages, and investment banks. Please see the About page for more information.

We have developed an extremely secure infrastructure with several layers of security. All data is encrypted at rest and in transit, is protected by firewalls, and is backed up regularly.

You are the beneficial owner of the securities. Our sub-custodian, Interactive Brokers, or sub-custodians appointed by Interactive Brokers are the legal owners of the securities and they hold the securities in trust for you. This system of ownership is common for foreign securities as the CHESS system is not available in foreign jurisdictions.

The dividends paid will be applied to your account in the local currency of the dividends.

You can elect this option for US stocks, only. However, it must be applied to all US stocks in your account. You can let us know by email notification to support@HALO.com.au.

Our reporting platform provides hassle-free tax reporting by sending you a statement that summarises all tax related transactions over the relevant reporting period.

As corporate actions arise, we will notify you as to your available options and then execute your instructions. If you do not respond to our notifications, a default option will be applied to the corporate action. Further information on the types of corporate actions that may occur and how they might affect your account can be found in our Corporate Actions Collection.

HALO is not a registered tax agent and does not provide tax advice. Please contact a registered tax agent for more details on the implication of investing in international shares.

The following information is intended only as a guide.

Australian tax residents, who are not U.S. tax residents, will have taxes withheld at 15% for U.S. sourced income as the result of a tax treaty between Australia and the U.S. Withholding rates from other jurisdictions will depend on tax treaties that may exist between that country and Australia. Note that we cannot guarantee that the withholding rates that are specified in the treaties are applied, and we are unable to help in recovery of tax withheld in foreign jurisdictions.

Australian tax residents, who are U.S. tax residents, will generally not have any withholding on U.S. sourced income.

HALO Global is a equities research and execution solution that allows users to analyse and invest in over 35,000 shares and ETFs across 30 exchanges.

HALO Global has been designed by professional fund managers to help investors save time, find better opportunities and make smarter decisions for their portfolios.

HALO Global has been designed by professional fund managers to help investors save time, find better opportunities and make smarter decisions for their portfolios.

If you are serious about improving your performance and growing your wealth, HALO Global can help.

Important:

Before making an investment decision, you should consider your personal circumstances, objectives and needs and seek a professional investment advice.

HALO Global is offered by HALO Technologies Pty Ltd ABN 54 623 830 866 which is a Corporate Authorised Representative No 1261916 of Macrovue Pty Ltd ABN 98 600 022 679, the holder of an Australian Financial Services Licence No 484264. Please read our Financial Services Guide for further information. We are also one of the few Australian companies to be registered as a Qualified Intermediary with the IRS in the U.S.

We have strong governance procedures in place and the management team has several decades of experience with leading fund managers, brokerages, and investment banks. Please see our About Us page for more information.

There are many great ideas out there. Finding discerning ways to turn those ideas into equity investments can be daunting when you have reams of data and information to wade through and limited access to professional analysis.

At HALO, we do the hard work for you. Our team is dedicated to constructing portfolios of 10 stocks each, called Vues, that give you exposure to a selected theme, while also allowing you the flexibility and control to fine-tune as you go.

We are targeting do-it-yourself investors looking for a new way to invest a portion of their savings and engaged in deciding how best to allocate their money. Our users demand the transparency and control that much of the superannuation industry doesn’t provide.

We are committed to looking beyond our own beautiful shores to opportunities in the world’s largest and most dynamic economies so that you don’t miss investing in the next chapter of China’s growth story or the U.S. recovery or the Internet of Things that’s reshaping our lives. The majority of our Vues are blind to borders, looking only for the stocks that best express a theme. So, not only are you diversified through multiple companies, you are also geographically diversified.

Come join us and explore a new world of ideas.

Unfortunately, we cannot accept US or Canadian Citizens/Residents for this product.

No. We only accept Australian Dollars. We are working on catering for USD, GBP and Euro deposits in the coming months.

Can I transfer positions to/from my HALO account?

Absolutely! Most stocks can be transferred to your HALO account. You either hold stocks at a broker (broker-sponsored) such as CommSec or nabtrade, or the shares are controlled by the issuer (issuer-sponsored) and held via a share registry such as Boardroom (added this as that’s where HALO shares are held), Computershare or Link Market Services. There may be some exemptions such as micro-cap stocks. If you would like to initiate a transfer of your positions in or out of your account you can complete the forms below to and email it to us support@halo-technologies.com.

Alternatively, if you would like to discuss your options regarding a position transfer, please do not hesitate to contact us.

What is the process of a position transfer?

For issuer sponsored holdings we need an up-to-date holdings statement detailing the ticker, quantity of shares held, the registry and your SRN/HIN where applicable and a signed position transfer form which you can request from support@halo-technologies.com . We will then send this to our custodian and the positions will settle in your account.

For broker sponsored holdings you need to complete the same forms above detailing the stocks you wish to transfer, your account number at the sending broker (you will need to provide two if you hold domestic and international shares), your broker information including a contact email and your signature granting us permission to initiate the transfer. We will send this signed form to your current broker and to our custodian. Once our request matches with your broker's instructions the stocks will settle into your account.

First, you will need to complete a trading account application.

To complete a transfer for Australian Dollars, you can request a deposit on trader. We will provide you with the secure transfer details for HALO trust account. We will notify you via email when your funds are available for investing.

To complete a transfer for any other currency, please contact HALO Support. We don’t support other CCYs yet.

Yes, you must be an Australian resident for tax purposes. The simplest way to think about this is whether you submit an Australian tax return?

The Australian Taxation Office provides more information if you have unique circumstances. The information can be found here: https://www.ato.gov.au/Individuals/International-tax-for-individuals/Work-out-your-tax-residency/

We offer individual, joint, self-managed super fund (“SMSF”), company, and trust accounts.

The process is fully online. All you need to do is fill in our online form with your personal information. We need to collect this in order to meet our legal obligations for anti-money laundering regulations.

It only takes about 5 minutes to complete the application for an individual account and you can always save and come back if you don’t have all the information on you.

We will email you as soon as your account is ready to trade.

Absolutely. Head to our website to activate your free 7-day trial of HALO Global. You will get access to all features and data sets for the trial period.

At the end of the trial, you can still access your HALO Trading account which allows you to invest in over 35,000 shares and ETFs.

A HALO Trading account is free to create an offers competitive brokerage for global equities.

A step-by-step guide to setting up your HALO Trading Account as a Trust Account.

Part A - Setting up application login details

Step 1: Go to https://app.halo-technologies.com/login

Step 2: Fill out the fields it requires. Note: for your password it needs to be a minimum of 8 characters, one capital and one number.

Step 3: Click ‘Join HALO’. An email will be sent to you title "Trading Application Approval required". Click on "Finalise Trading Account application".

Step 4: You will be prompted to login using the username and password provided. Please re-set your password and log out.

Step 5: Login to your HALO account with your username and new password.

Step 6: Click on ‘Apply Now’ to navigate to Trading Application. You can also click ‘Complete a trading application’.

Part B - Setting up as a Trust Account

Scroll down and select the type of trust:

approval by clicking ‘submit application’.

If you have any questions, please contact Client Services on 1300 720 292.

Part A - Setting up application login details

Step 1: Go to https://app.halo-technologies.com/login

Step 2: Fill out the fields it requires. Note: for your password it needs to be a minimum of 8 characters, one capital and one number.

Step 3: Click ‘Join HALO’. An email will be sent to you title "Trading Application Approval required". Click on "Finalise Trading Account application".

Step 4: You will be prompted to login using the username and password provided. Please re-set your password and log out.

Step 5: Login to your HALO account with your username and new password.

Step 6: Click on ‘Apply Now’ to navigate to Trading Application. You can also click ‘Complete a trading application’.

Part B - Completing your Individual Account application

Step 1:

Your application will then be sent off for approval which will take approx. 1 business day.

Part A - Setting up application login details

Step 1: Go to https://app.halo-technologies.com/login

Step 2: Fill out the fields it requires. Note: for your password it needs to be a minimum of 8 characters, one capital and one number.

Step 3: Click ‘Join HALO’. An email will be sent to you title "Trading Application Approval required". Click on "Finalise Trading Account application".

Step 4: You will be prompted to login using the username and password provided. Please re-set your password and log out.

Step 5: Login to your HALO account with your username and new password.

Step 6: Click on ‘Apply Now’ to navigate to Trading Application. You can also click ‘Complete a trading application’.

Part B - Completing your SMSF Account application

Step 1:

. your industry (e.g. retired; retail),

primary source of Funds (e.g. employment income; investment income if retired)

Primary source of Wealth

Complete steps 11-15 for any other applicants.

Accept the acknowledgements at the end of the page and sign with your name as a digital signature. Given that HALO is an international investing platform and will be used to access US markets through Interactive Brokers they must confirm that you are not a US resident or taxpayer, or a resident of a country currently sanctioned by the US (e.g. North Korea).

If you would like further assistance, please contact client services on 1300 720 292.

Step by step guide to setting up your HALO Trading account as a Company account.

Part A - Setting up application login details

Step 1: Go to https://app.halo-technologies.com/login

Step 2: Fill out the fields it requires. Note: for your password it needs to be a minimum of 8 characters, one capital and one number.

Step 3: Click ‘Join HALO’. An email will be sent to you title "Trading Application Approval required". Click on "Finalise Trading Account application".

Step 4: You will be prompted to login using the username and password provided. Please re-set your password and log out.

Step 5: Login to your HALO account with your username and new password.

Step 6: Click on ‘Apply Now’ to navigate to Trading Application. You can also click ‘Complete a trading application’.

Part B - Setting up as a Company Account

or the Sole Director where appropriate.

Provide the details for the company including: (Bold are required, and you should make sure you have these when you start)

Fill out your personal details

Your address is your residential address, cannot be a PO box but can enter that as

mailing address later.

When you reach the Country of Citizenship/Birth section remember to click the country which

will appear in the drop-down menu.

Should require further assistance please contact client services on 1300 720 292.

Step by Step guide to setting up your HALO account as a Joint account.

Part A - Setting up application login details

Step 1: Go to https://app.halo-technologies.com/login

Step 2: Fill out the fields it requires. Note: for your password it needs to be a minimum of 8 characters, one capital and one number.

Step 3: Click ‘Join HALO’. An email will be sent to you title "Trading Application Approval required". Click on "Finalise Trading Account application".

Step 4: You will be prompted to login using the username and password provided. Please re-set your password and log out.

Step 5: Login to your HALO account with your username and new password.

Step 6: Click on ‘Apply Now’ to navigate to Trading Application. You can also click ‘Complete a trading application’.

Part B - Setting up a Joint Account

This is required by law.

Our data feed shows the last price for each of your positions as at the close of the relevant stock market. As we operate in a number of international markets, there will be a delay in the performance data based on when the relevant market closes. For example, you will often see your performance data for US stocks in the afternoon Australian time, after the US market closes - however your European stocks will have updated data available in the morning Australian time as European markets are open earlier relative to US markets.

The aggregate measure of Growth for a Vue is calculated using reported past and future earnings growth estimates. One notch signifies lower growth while five notches reflects higher growth potential.

The aggregate measure of Valuation for the Vue is calculated using relative values measures such as free cash flow yield, earnings yield, and other empirically tested metrics. One notch signifies relative expensiveness while five notches signifies relative cheapness.

The aggregate measure of Risk for the Vue is calculated using the standard deviation of the share prices of the underlying shares in the Vue over the past 12 months. One notch signifies a narrower share price trading band of the constituent stocks in the Vue, and consequently lower risk, while five notches signifies higher risk (and wider share price trading band).

One of the best features of HALO is the display of performance. We provide returns data in both dollar and percentage terms.

The performance of your overall portfolio or a Vue you have invested in is measured as:

Capital Gain/Loss + Income + Currency Gain/Loss = Total Return.

The meaning of each term is outlined below:

Capital Gain/Loss – The change in dollar value of the underlying holdings calculated over relevant period in local currency converted to AUD based on daily mid spot rate at 4:00pm (GMT). This may also be calculated as a percentage.

Income – The total cash dividend payments received over relevant period in local currency converted to AUD based on daily mid spot rate at 4:00pm (GMT). This may also be calculated as a percentage.

Currency Gain/Loss – The dollar return derived from changes in the valuation of the underlying holdings due to exchange rate movements over relevant period converted to AUD based on daily mid spot rate at 4:00pm (GMT). This may also be calculated as a percentage.

Total Return – The dollar sum of Capital Gain/Loss, Income, and Currency Gain/Loss. This may also be calculated as a percentage.

Portfolio performance is calculated by Sharesight. Performance calculation methodology can be found here.

Spinoffs are corporate manoeuvres where a company separates a part of its business.

Shareholders in the parent company continue to hold this company but also receive shares in the new entity.

The cost basis of the parent company is reduced by the value of the spinoff and the cost basis for the spinoff stocks is set at their market value on the day of the event.

Stocks are merged to form a smaller number of effectively more valuable shares.

There will be a reduction in the quantity of shares, but the value of your total holdings stays the same.

It is not a tax event, but your cost price will be adjusted for the purpose of tax reporting.

A merger occurs when two existing companies combine into one new company or when one company acquires another.

When a merger occurs, the original stock will cease to exist. According to the ATO, the capital proceeds for the original shares are the total of the market value of the new shares received at the time of the takeover, and the money received (if any). The cost of acquiring the shares in the takeover or merged company is the market value of original shares at the time the other shares are acquired, reduced by any cash proceeds.

You will cease to hold a specific stock and be issued with a different stock or with cash.

If a company in which you owned shares was taken over and you received new shares in exchange for your original shares, you may be entitled to a scrip-for-scrip rollover. The rollover allows you to defer paying CGT until a later CGT event happens (for example if you later dispose of the shares you acquired in the takeover). The rollover doesn't apply if you made a capital loss. For the purpose of tax reporting we report all mergers as capital gain events and leave it to the discretion of the shareholder to determine if they are eligible for scrip-for-scrip rollover.

When a company issues new shares to shareholders in proportion to their current holdings.

There will be an increase in the quantity of shares, but value of your total holdings stays the same.

It is not a tax event, but your cost price will be adjusted for the purpose of tax reporting.

The shareholder is issued a dividend which then gets invested in the given stock.

Rather than your cash holdings increasing you will reinvest this into the stock in question.

The tax implication is a modified cost basis and the dividend reported as income.

This corporate action involves shares being bought back by the company or an investor and are a tax event.

A stock buyback, also known as a "share repurchase", is the process by which shares are bought back from the open market. There are two types:

Tender: A tender offer is when an investor proposes buying shares from every shareholder of a publicly traded company for a certain price at a certain time. The investor normally offers a higher price per share than the company’s stock price, providing shareholders a greater incentive to sell their shares.

Open Market: a company has to buy shares on the open market, just like an individual investor would, at the market price.

If you choose to sell your shares you will no longer hold those stocks and you will be issued with cash in return.

The selling of shares in a buyback is a tax event and the income is classified as a capital gain (or loss).

A rights issue is an issue of rights to a company's existing shareholders that entitles them to buy additional shares directly from the company in proportion to their existing holdings, often at a discount to the market price. Rights are often transferable, allowing the holder to sell them on the open market. You have 3 options when considering a rights offering:

If you choose to subscribe you will be able to purchase additional shares, often at a discount.

The actual purchase of rights is not a tax event, however, as there is often a discounted price your overall cost basis may be altered. The sale of rights is a tax event and you will need to report this income as capital gains.

Corporate actions are offers issued by a publicly traded company that affects the securities issued by a company.

Corporate actions are offers issued by a publicly traded company that affects the securities issued by a company. They may have an impact on reportable capital gains and income. There are two types of corporate actions: voluntary and mandatory. Voluntary corporate actions mean shareholders can elect to participate. These may include rights issues, buybacks and dividend payments. Mandatory corporate actions are automatically applied as they do not provide shareholders with the option to participate or not participate. These may relate to company restructure, such as mergers.

Most corporate action instructions need to be submitted 7 days before the expiration of the offer.

Dividends can be in the form of cash or stock. Cash dividends are payments made by the company to shareholders in the form of cash. Stock dividends are new shares given to shareholders.

Cash dividends will increase your cash holdings and may provide a regular income on investment. Stock dividends provide shareholders with the choice to keep the stock or change it into cash.

Dividends are a form of income and must be reported in annual tax returns.

Dividends from US-based Publicly Traded Partnerships.

US Tax withholding on distributions from Publicly Traded Partnerships (a type of limited partnership) is withheld at 37% (2018) as this is earned income in the US.

We give you the ability to view currency, dividend and share capital gains as well as prepare hassle-free end-of-year tax reports for your holdings. However, we do not offer any tax advice and you are responsible for your own tax filings.

When you sell your shares, the proceeds will be credited to your account after the settlement date. Settlement dates vary generally between two to three business days, depending on the jurisdiction involved. In unusual circumstances, market conditions can sometimes lead to an increase in settlement time. By default, the funds will be left in local foreign currency after settlement of trades. If you want to convert the funds to Australian Dollars, you can instruct us to do so on your behalf.

Yes, HALO does enable you to place limit orders and stop-loss orders.

We enable the cancellation of limit orders and there is no penalty charge.

Trading international shares is a complicated endeavour. There are several moving parts for a transaction, including:

To keep your experience as simple as possible, HALO builds in a buffer into the amount you’d like to invest in order to account for movements across each of the factors outlined above. This buffer is designed to maximise the amount available for you to invest.

HALO’s algorithm attempts to perform an equal allocation across all the selected shares, essentially trying to split the notional amount invested equally across the shares. Where this is not possible, as a result of minimum investment sizes, liquidity constraints, or other factors, our system will make its best effort to achieve an equal allocation in dollar terms across all the selected shares.

If you wish to change the allocation from what the system has calculated, you may go to the underlying shares and change the relevant quantity.

HALO enables you to trade in the following countries:

North America

Europe

Asia Pacific

Yes, you can purchase any one of the approximately 20,000 stocks we have on our database.

You can also customise any Vues to remove individual stocks before purchase, and if you have already purchased a Vue but want to sell just one stock, you can do that as well.

The Vues page shows the Vues that are available for investment. You can explore each individual Vue to find the research thesis behind the Vue, detailed metrics and the list of shares. You have the choice to modify the Vue or if you’re happy with the current share picks, you can click to buy the Vue from this page.

Selecting Buy Vue will take you to the allocation step. By default, the allocation page displays the minimum possible investment in the Vue. You can choose any amount above the minimum and our allocate feature will attempt to provide an equal allocation in dollar terms across each of the shares automatically. If you wish to construct your own allocation, you can modify this accordingly.

There is also an option to select order type. Currently, you can choose either Market Order or Limit order. The default is set to Market Order.

Once you’re happy with the Vue, select proceed to confirm. This final step is designed to ensure that no inadvertent errors are passed through to the market for execution. Once you have confirmed your order, our system will acknowledge that it has received the order and then send it to the market for execution. You will receive a fill confirmation by e-mail once the trade has been executed.

ASX-listed share prices are updated every 20 minutes. U.S-based shares are updated every 60 minutes. All other prices are based on previous day closing prices which are converted into Australian Dollars.

ADRs allow U.S. banks to purchase a bulk lot of shares from a foreign company, bundle the shares into groups and reissue them on U.S. stock markets.

American Depositary Receipts (ADRs) are stocks that trade in the U.S. but represent a specified number of shares in a foreign corporation – such as Alibaba (BABA). Like regular U.S stocks, ADRs are bought and sold on U.S. markets. They also trade in U.S. dollars and clear through U.S. settlement systems.

ADRs were developed because of the complexities involved in buying shares in foreign countries and the difficulties associated with trading at different prices and currency values. ADRs allow U.S. banks to purchase a bulk lot of shares from a foreign company, bundle the shares into groups and reissue them on U.S. stock markets – namely, the New York Stock Exchange and NASDAQ.

Source: Investopedia

When placing a trade on a Vue or an individual stock HALO will allocate 5% of your available capital at the time to a buffer.

This buffer ensures that the order will be filled in the event that there are any currency movements while the trade is being executed. Market orders on ASX listed stocks will also attract the buffer to ensure that the order is executed successfully in the event of price movements. The buffer amount will be ‘blocked’ while the trade is waiting to be executed and any unused portion will be unblocked once the order is filled.

For example: If you have $10,000 in funds in your HALO cash holdings only $9500.00 will be available to place a trade.

The brokerage fees that HALO provides is an estimated value only. It is impossible to know the final amount invested, and the exchange rates achieved, until the trade is actually fulfilled. Unless in times of extreme volatility, the estimate and actual fees should be very similar.

In addition to fees charged by HALO, transactions may be subject to taxes and duties from foreign exchanges and governments. While we make our best efforts to keep these charges estimated, it may be that fee structures change without our knowledge.

No, we don’t charge anything extra for customising or creating your own Vue.

We do not charge any Custodial fees.

The cost for any transactions in a Vue is simply the sum of the cost of the individual transactions whether they are purchases or sales.

When buying or selling shares, HALO charges brokerage and currency conversion fees for each transaction. There may be additional taxes and fees charged by exchanges and countries in foreign jurisdictions which we pass on to you.

If you are investing in our Vues, you will be charged a research fee of a research fee per annum (calculated daily and charged monthly) on the market value of the holdings in the Vue. This is in addition to the standard brokerage and currency conversion fees for any buy or sell transactions.

An annual platform access fee is also payable.

Vues are reviewed every 3 months and updated if necessary. We will notify you of changes, if any. You have the option to follow through and implement the changes in your Vue, but we do not automatically rebalance on your behalf. Once you have purchased a Vue, you have complete control over how the Vue is managed, meaning you can decide to change the allocations to something that may better suit your personal circumstances, or remain invested in better performers over time.

We cannot provide you personal advice since we do not know your circumstances and are not licensed to do so.

However, we believe that investing in thematic Vues should be part of a broad investment strategy, where exposure to Vues gives your added diversification to your existing portfolio of assets.

HALO enables you to invest in portfolios of 10 shares each. Holding more shares reduces your risk relative to holding just a single company. This is because companies can operate in different parts across the value chain, in industries, and in different countries at different stages of the economic cycle. Each of these factors spreads out your risk so your portfolio becomes less sensitive to events in any one company, industry or geography.

The stock trading exchanges we work with may require a minimum trade amount, or minimum quantity per shares. When you purchase a Vue, we will tell you what the minimum amount required is.

Unlike ETFs and managed funds, Vues give you full transparency and you can add/remove shares in a Vue. While we do recommend shares in Vues and provide regular updates to the recommendations, we do not manage your portfolio for you. You will always be in full control of your investment.

When you invest in Vues, you are the beneficial owner of the individual shares, unlike managed funds and ETFs. Hence you may also receive tax benefits since tax gains and losses are not shared with other investors in a pooled vehicle.

Also, unlike index tracking ETFs, we pick stocks that we believe are likely to outperform others with exposure to the theme.

HALO constructs Vues designed around a theme using our in-house team of investment experts that have extensive experience in financial markets with institutions such as AMP, Perennial, Legal & General, Bank of America Merrill Lynch and Putnam Investments.

We also let users create and invest in their own Vues.

A Vue is a portfolio of 10 professionally-selected shares that align to a specific market, industry, trend, theme or investment style.

A Vue is simply a basket of 10 professionally-selected shares that provides exposure to a specific market, industry, trend, theme or investment style, e.g.:

Unlike an ETF or managed fund, when you invest in a Vue you are actually purchasing shares in the 10 recommended companies and therefore become the beneficial owner of the shares. This provides you a level of control and transparency not offered by ETFs and managed funds.

Vues can been seen as an alternative to managed funds and ETFs, and may appeal to investors who wish to have more control and transparency when it comes to their investments.

Vues offer the following features and benefits:

Your initial cash deposit is received in HALO’s trust account at ANZ. We move this cash balance to Interactive Brokers within two business days.

If we are acquired or go public, your portfolio and funds held with us will remain secure and you will, as at any point, have the ability to close your HALO account, sell your holdings and withdraw your savings.

In the unlikely event we close, which we don’t foresee, we will give you the choice of transferring your positions and cash to another broker.

We have developed an extremely secure infrastructure with several layers of security. All data is encrypted at rest and in transit, is protected by firewalls, and is backed up regularly.

HALO is operated by HALO Technologies Pty Ltd (ABN 54 623 830 866) and holds an Australian Financial Services Licence (484264) issued by ASIC. Please read our Financial Services Guide for further information. We are also one of the few Australian companies to be registered as a Qualified Intermediary with the IRS in the U.S.

We are well funded by publicly listed institutions such as AMP, and venture capitalists such as H2 Ventures and Gatica Investments.

We have strong governance procedures in place and the management team has several decades of experience with leading fund managers, brokerages, and investment banks. Please see the About page for more information.

We have developed an extremely secure infrastructure with several layers of security. All data is encrypted at rest and in transit, is protected by firewalls, and is backed up regularly.

You are the beneficial owner of the securities. Our sub-custodian, Interactive Brokers, or sub-custodians appointed by Interactive Brokers are the legal owners of the securities and they hold the securities in trust for you. This system of ownership is common for foreign securities as the CHESS system is not available in foreign jurisdictions.

The dividends paid will be applied to your account in the local currency of the dividends.

You can elect this option for US stocks, only. However, it must be applied to all US stocks in your account. You can let us know by email notification to support@HALO.com.au.

Our reporting platform provides hassle-free tax reporting by sending you a statement that summarises all tax related transactions over the relevant reporting period.

As corporate actions arise, we will notify you as to your available options and then execute your instructions. If you do not respond to our notifications, a default option will be applied to the corporate action. Further information on the types of corporate actions that may occur and how they might affect your account can be found in our Corporate Actions Collection.

HALO is not a registered tax agent and does not provide tax advice. Please contact a registered tax agent for more details on the implication of investing in international shares.

The following information is intended only as a guide.

Australian tax residents, who are not U.S. tax residents, will have taxes withheld at 15% for U.S. sourced income as the result of a tax treaty between Australia and the U.S. Withholding rates from other jurisdictions will depend on tax treaties that may exist between that country and Australia. Note that we cannot guarantee that the withholding rates that are specified in the treaties are applied, and we are unable to help in recovery of tax withheld in foreign jurisdictions.

Australian tax residents, who are U.S. tax residents, will generally not have any withholding on U.S. sourced income.

Get the latest insights and hot tips delivered right to your inbox

HALO Technologies Pty Ltd ABN 54 623 830 866 is a Corporate Authorised Representative No 1261916 of Macrovue Pty Ltd ABN 98 600 022 679 AFSL 484264. Macrovue Pty Ltd is a wholly owned subsidiary of HALO Technologies Pty Ltd.